FxWirePro: CAD/JPY option strips to hedge both bearish/bullish scenarios in major trend

Nov 22, 2017 09:13 am UTC| Central Banks Research & Analysis Insights & Views

The Bank of Canada (BoC) is likely to have taken a deep breath when it saw the October inflation data on Friday. It fell from 1.6% to 1.4% YoY. The different measures of core inflation also eased slightly and now range...

MNB keeps interest rates on hold, to introduce two unconventional instruments from January 2018

Nov 21, 2017 15:46 pm UTC| Commentary Central Banks

On Tuesday, the Hungarian central bank kept its interest rates on hold at record low levels, consistent with expectations. He MNB stated that it will be prepared to further ease monetary conditions to drive borrowing costs...

Nov 21, 2017 11:22 am UTC| Research & Analysis Insights & Views Technicals Central Banks

KRW is right under the spotlight. USDKRW dipped below the 1100 mark, heading the lowest in more than two years. While the Bank of Korea (BOK) continues to warn that it would take actions if there is excessive KRW...

Nov 21, 2017 10:30 am UTC| Research & Analysis Central Banks Insights & Views

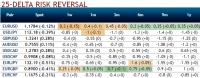

Please be noted that the USDCAD OTC market sentiments show bullish neutral flashes, while positively skewed IVs of 3m tenors signify the hedgers interests in OTM calls. Refer above nutshell wherein hedgers seem interested...

Fundamentals to watch out for this week

Nov 20, 2017 10:49 am UTC| Commentary Central Banks

This week is a relatively light with volatility risks, both in terms of data and events. What to watch for over the coming days: Central Banks: European Central Bank (ECB) president Draghi is set for a speech...

Fed Hike aftermath Series: Hike probabilities over next 12 months

Nov 20, 2017 09:29 am UTC| Commentary Central Banks

Hike probability sharply spiked after last FOMC meeting, where projection material showed that the U.S. Federal Reserve is still projecting one more hike for 2017, which is likely to be December. The November FOMC...

Bank of England likely to raise rates by 25 bps every six months, says Nomura Research

Nov 20, 2017 06:03 am UTC| Commentary Central Banks Economy

The Bank of England (BoE) is expected to raise its benchmark interest rates by around 25 basis points in every six months, the next move being at the time of the May 2018 Inflation Report, according to a forecast by Nomura...

- Market Data