May 28, 2018 13:41 pm UTC| Research & Analysis Central Banks Insights & Views

This write-up runs us through the parallels between Italy and Turkey. President Recep Tayyip Erdogan too blames the messenger, in his case: the financial markets (implicitly: the foreign financial markets) for the lira...

Fundamentals to watch out for this week

May 28, 2018 10:26 am UTC| Commentary Central Banks

In terms of volatility risks, this week is relatively heavy both in terms of data and events. What to watch for over the coming days: Central Banks: U.S. Federal Reserves Bullard to speak Tuesday, Bank of...

May 28, 2018 08:31 am UTC| Commentary Central Banks Economy

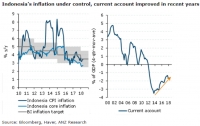

Bank Indonesia is expected to hike its benchmark interest rate by 25 basis points at the unscheduled central bank meeting on Wednesday, May 30.Other measures to stabilize financial markets could also be announced,...

Fed Hike aftermath Series: Hike probabilities over coming meetings

May 28, 2018 06:51 am UTC| Commentary Central Banks

FOMC increased interest rates in March and maintained its forecast for three rate hikes in 2018. FOMC also forecasted a faster pace of hikes next year than previously forecasted. March decision was unanimous. Current...

FxWirePro: The Day Ahead- 25th May 2018

May 25, 2018 05:48 am UTC| Commentary Central Banks

Not many economic data and events scheduled for today, but some with high volatility risks associated. Upcoming: Germany: IFO survey report will be released at 8:00 GMT. United Kingdom: BBA mortgage report...

Bank of Korea keeps interest rates on hold, economy to grow 3 pct in 2018

May 24, 2018 13:32 pm UTC| Commentary Central Banks

The Bank of Korea kept its key interest rates on hold at 1.5 percent today during its policy meeting. However, the statement was more dovish than expected. Korean economic growth is likely to reach 3 percent in 2018,...

FxWirePro: Low vols and depressed risk reversals - Shorting EUR/CNH call to finance USD/CNH calls

May 24, 2018 09:47 am UTC| Research & Analysis Insights & Views Central Banks

If you are reckoning about a break in the dollar appreciation trend, then USD calls seem to be cheaper relative to spot retracement headroom in CNH, thus, we advise the best value in USD calls judging from the number of...

- Market Data