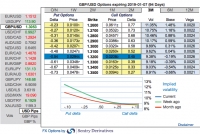

FxWirePro: USMCA, Italian yields and BoC – Centre of attraction of FX option markets

Oct 09, 2018 12:14 pm UTC| Research & Analysis Insights & Views Central Banks

The new USMCA (United States-Mexico-Canada Agreement)deal (replacing NAFTA) has been announced last Sunday, that was greeted by the market as risk-benign, supporting the decline of FX vols (for EM and CAD in particular) as...

Fundamentals to watch out for this week

Oct 08, 2018 11:25 am UTC| Commentary Central Banks

In terms of volatility risks, this week is relatively light due to a lack of economic data, as well as central bank meetings. What to watch for over the coming days: Central Banks: Bank of England (BoE) will...

Fed Hike aftermath Series: Hike probabilities over coming meetings

Oct 08, 2018 09:32 am UTC| Commentary Central Banks

FOMC increased interest rates in March, June and in September. Increased its forecast from three rate hikes in 2018 to four rate hikes. September decision was unanimous. Current Federal funds rate - 200-225 bps (Note, all...

PBoC’s RRR cut likely to engineer a credit impulse into the economy, says ANZ Research

Oct 08, 2018 05:45 am UTC| Commentary Economy Central Banks

The Peoples Bank of China (PBoC) has cut the reserve requirement ratio (RRR) for most banks by 100bps, effective from October 15. According to the official press release, the cut will release a total of CNY1.2 trillion...

Oct 05, 2018 11:56 am UTC| Research & Analysis Central Banks

Take a quick glance at some key fundamentals: As we continue to foresee the trade apprehensions ratchet up, the GBPUSD likely to prolong its apprehensions amid minor spikes in a typical risk off move. While the bearish...

FxWirePro: Projections and positioning RUB via optionality on unpredictable geopolitical risks

Oct 04, 2018 13:59 pm UTC| Research & Analysis Central Banks

Recently, the Russian central bank (CBR) announced that it was officially suspending FX purchases on behalf of the finance ministry until the end of this year; it added that it may resume FX purchases in 2019 but the issue...

FxWirePro: Bonds in decline as U.S. economy gathers momentum

Oct 04, 2018 05:47 am UTC| Commentary Central Banks Economy

The U.S. bond market is undergoing a major selloff since yesterday with yields reaching multi-year highs, as the latest batch of strong economic numbers sparked inflation concerns amid the possibility of further rate hikes...

- Market Data