The Reserve Bank of New Zealand (RBNZ) may actually need to cut benchmark interest rates in order for NZGBs to further outperform their global peers from current levels, according to the latest report from ANZ Research.

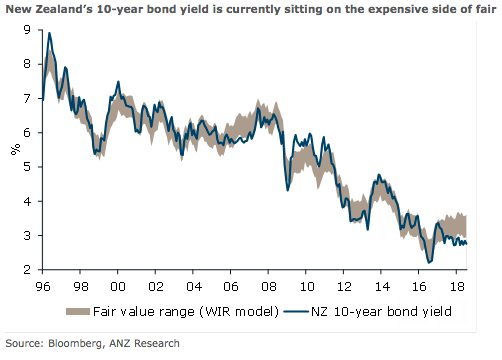

New Zealand’s 10-year government bond yield has decoupled from the US, with the relative outlooks for monetary policy explaining most, but not all, of that divergence. It is a similar story when comparing New Zealand’s 10-year yield with a broader measure of the ‘world’ interest rate (estimated using principal components).

New Zealand bonds are starting to look a touch expensive. A solid local fiscal situation, improved external debt metrics and low global volatility perhaps help explain this outperformance (on top of domestic monetary policy of course), the report added.

The Government’s underlying fiscal balance is currently in surplus to the tune of 2 percent of GDP. This is the largest surplus since 2008 and the Government is projecting it to roughly hold around this level over the next four years.

"While we only have history back to 2009, we estimate that New Zealand’s sovereign CDS spread, at around 18bps, is sitting around the 5th percentile currently, implying the market sees very low default risk,” the report also commented.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy