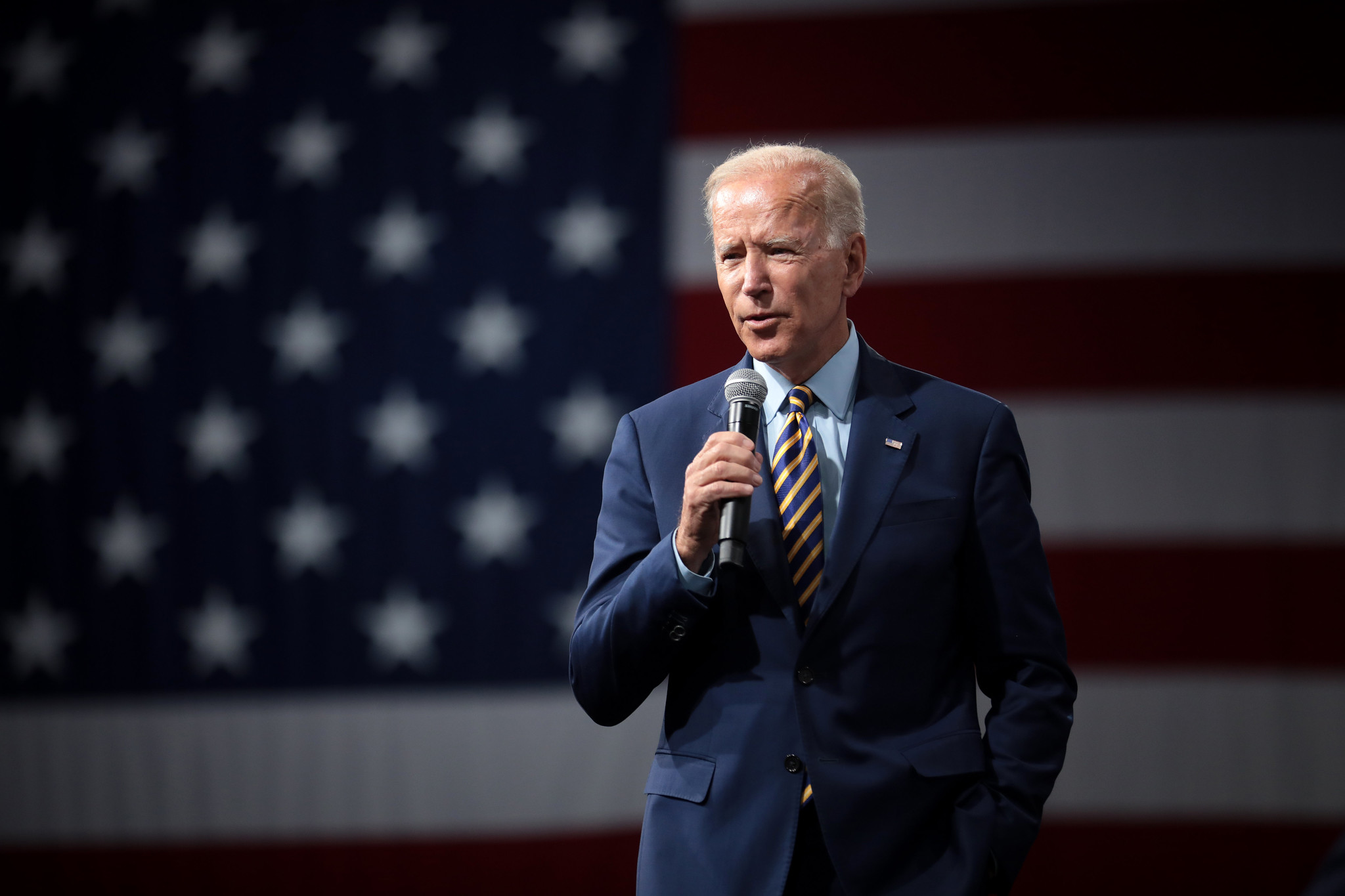

Next week, the House of Representatives will vote on President Biden's veto of the SAB 121 rule, a pivotal regulation affecting how SEC-reporting entities manage cryptocurrency custody on their balance sheets.

House Faces Critical Vote on Biden's Veto of SAB 121, Crypto Custody Rule in Balance

Although the House and Senate have already voted to repeal SAB 121, a two-thirds majority resolution from both chambers will be required to invalidate Biden's veto.

The House of Representatives may vote on President Joe Biden's controversial veto to prevent Staff Accounting Bulletin 121 next week.

According to a weekly schedule posted by House Majority Leader Steve Scalise (via Cointelegraph), SAB 121, a proposed rule that requires SEC-reporting entities custodying cryptocurrencies to record those holdings on their balance sheets, is presently on the House's "legislation that may be considered" list.

The House is constitutionally obligated to vote to overturn or sustain presidential vetoes; therefore, it must vote once more. The elections may occur on either July 9 or July 10.

Biden's Veto of SAB 121 Faces Challenge as Bipartisan Efforts Seek Overturn in House and Senate

In May, a resolution to repeal the Securities and Exchange Commission's SAB 121 rule won bipartisan support in the House (228-182 ballots) and Senate (60-38). However, Biden vetoed the resolution later that month.

Opponents contend that SAB 121 would obstruct American banks from custodying cryptocurrency exchange-traded products at scale, potentially resulting in a "concentration risk" by transferring more control to non-bank entities.

Nevertheless, to overturn Biden's veto, a two-thirds majority vote from both the House and Senate will be required.

In May, the resolution was supported by only 55.6% and 61.2% of the House and Senate members, respectively. Consequently, Democrats will require even more support this time.

“Steep hill to climb but not impossible given how bipartisan the FIT vote was,” explained Alexander Grieve, who tackles government affairs issues at cryptocurrency investment firm Paradigm.

In May, the House passed the Financial Innovation and Technology for the 21st Century Act, designed to clarify how U.S. commodities and securities regulators address cryptocurrency-related issues. The vote was 279-136.

In the interim, Biden and Republican candidate Donald Trump are intensifying their campaigning in anticipation of the November 2024 U.S. election.

Kerri Langlais, chief security officer at Bitcoin miner TeraWulf, recently informed Cointelegraph that both candidates have devoted more attention to digital asset-related issues in recent months, a "positive development" for the industry.

“Albeit to different degrees, both Biden and Trump’s original positions on crypto have shifted favorably our way in the last year. We should continue to build on that progress with our education and political efforts.”

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms

U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms  Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall

Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions

Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions  TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans

TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape