The Corona crisis has hit the British economy comparatively hard. In addition, Brexit risks remain high, which is why we assume that the pound will continue to remain weak against the euro.

Given that the UK and EU should have a strong interest in the conclusion of a free trade agreement, not least due to the already difficult economic situation caused by the corona crisis, our economists are confident that an agreement on at least a partial trade deal which covers the most important areas remains possible in the next couple of months. Nevertheless, they acknowledge that the probability of a no-deal Brexit has increased significantly. For this reason, we are forecasting a weak pound in the short term and only a very moderate recovery later in the year. In fact, there is a high risk that the pound will suffer much more severe setbacks in the meantime than our forecasts suggest due to rising Brexit risks. Exchange rate volatility is likely to increase particularly towards the end of the year when the UK is due to actually leave the EU single market.

As a result, our defensive stance in EURGBP has been dictated by the receding global economic tide, but we cannot ignore that geopolitical and economic risk has been an instrumental factor in these worse macro outturns. This warrants a tactical reduction in our defensive exposure but we uphold our hedging portfolios via 3-way straddles.

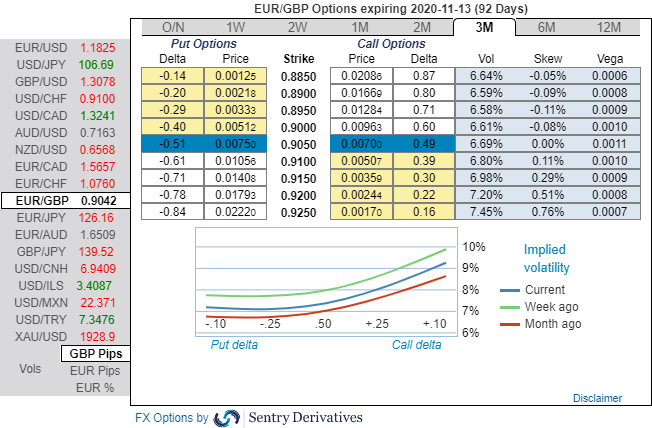

Let’s just quickly glance at OTC updates & suitable options strategy:

The positively skewed IVs of 3m tenors are indicating upside risks, more bids are observed for OTM call strikes up to 0.9250 levels.

While mild bearish hedging setup is observed for the existing EURGBP bullish risk reversal setup across all tenors substantiates upside risks.

Accordingly, at spot reference: 0.9046 levels, we upheld our shorts in GBP on hedging grounds via 3-month (0.89/0.9250) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our GBP recommendations.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One