The recent slide in the US dollar has continued with the greenback dropping by around 4% against the euro so far in July alone to around 1.17. The move against the pound has been less pronounced but has seen GBPUSD move up above 1.28 despite ongoing Brexit negotiations weighing on sentiment. Of late, in the US, Fed policymakers have been very vocal about their worries that the economic recovery could falter with the rise in Covid-19. Last week’s reported increase in US jobless claims won’t alleviate those worries.

Market sentiment, risk of a US 2nd wave and US election have all concurred in driving the US Dollar down over the past 6-weeks or so. EUR remained supported yesterday as ECB kept rates and its emergency monetary stimulus unchanged. As the dollar dropped more than 6% on a trade-weighted basis from end of March highs, there has been interest from market participants in obtaining some correlation-discount when selling the Dollar. The cross-asset strategy team maintains a bullish stance on markets, given cheapness of Equities over bonds, policy support and rebound in growth, unlikely to be put at risk by new lockdowns.

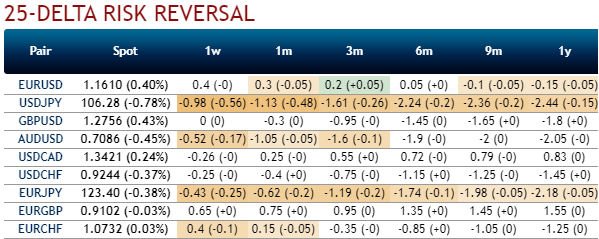

In the FX vol space, the picture above is consistent with the steady decline of vol levels since late March, and with the output of our tactical filter keeping a short-Gamma bias since May, after flashing the most extreme risk-off signals on record throughout March and into April. Yet, low valuations from a historical standpoint and a macro agenda that could trigger vols in the second half of the year made us support a slightly more defensive positioning, favoring RVs over outright short vol (RVs and vol ratio spreads still the game).

In our upcoming posts, we propose directional and long-Theta constructs by investigating the interdependence of smile, vol curves and correlation parameters.

EURUSD risk reversals have still been indicating the hedging sentiments for the bearish risks in the long run, as the fresh negative bids are added to the positive RRs for 1-3m tenors (1st chart).

Most importantly, the positively skewed EURUSD IVs of 3m tenors are stretched on either side but with slight biasness towards downside hedging risks (refer 2nd chart), while IVs are shrunk below 6.75% across major tenors. Courtesy: JPM

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings