Bearish EURNZD Scenarios:

1) ECB goes all-in with rates cuts, tiering and QE.

2) Trump proceeds with tariffs on Euro car imports.

3) A no-deal Brexit.

4) Kiwis fiscal easing is accelerated;

5) Housing begins to lift thanks to lower mortgage rates and a winding back of LVR restrictions.

Bullish EURNZD Scenarios:

1) Trump sanctions unilateral FX intervention to weaken USD.

2) A US-China peace treaty on trade.

3) Euro area economy rebounds to a sustained 1.5%+ growth rate and re- acceleration of CB demand for EUR.

4) The housing market slowdown becomes deeper due to credit tightening by banks;

5) The immigration rolls over more quickly;

6) The global risk assets start to respond more sharply to global trade and growth concerns.

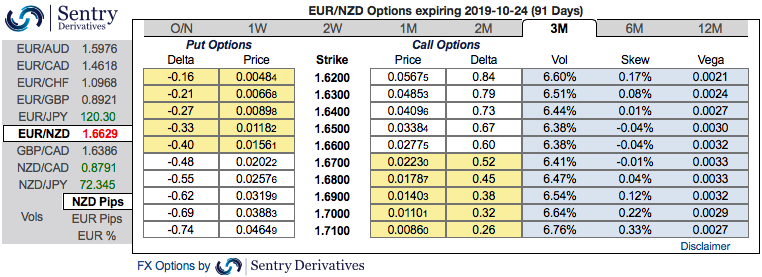

OTC outlook and Hedging Strategy:

Please be noted that the positively skewed IVs (implied volatilities) of 3m tenors signify the hedgers’ interests on both upside and downside risks (refer above nutshell). Bids for OTM calls and OTM put strikes up to 1.71 and 1.62 levels are observed ahead of ECB monetary policy that is scheduled for tomorrow.

Contemplating all the above factors, we could foresee upside risks of this pair. Hence, we advocate 3m (1%) in the money delta call options.

Thereby, in the money call option with a very strong delta will move in tandem with the underlying spot fx.

Alternatively, we also advocate directional hedges as downside risks in the near terms are foreseen ahead of ECB’s monetary policy, initiate shorts in EURNZD futures contracts of near month expiries and simultaneously, longs in mid-month tenors with a view to arresting major uptrend. Courtesy: Sentrix & JPM

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal