We have been expecting the RBA to cut in July and August, motivated mostly by concerns about the activity data. But with inflation now drifting even further off track, we have brought this forward to cuts in May and June (25bp each), on the grounds that the Bank will be unable to defend a SoMP forecast set showing a return to the target without immediate policy action.

Aussie dollar attempted to gain the upside traction momentarily but exhausted below 7-DMAs ahead of the above event. AUDUSD has been weakening since last month and got a kick along from the CPI result.

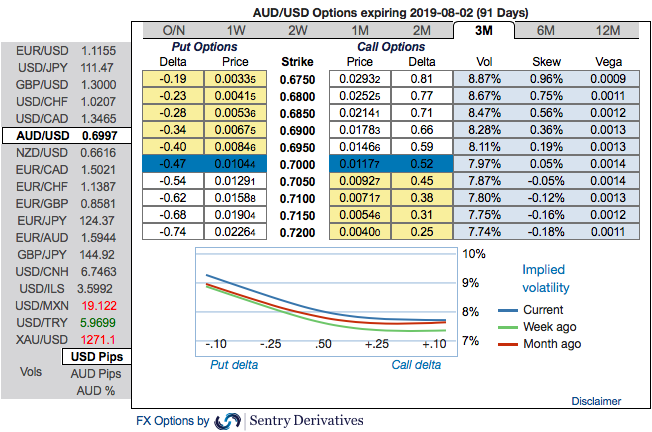

We will now quickly run you through OTC outlook of AUDUSD, before proceeding further into the options strategic framework.

Please be noted that the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 0.6750 level which is in line with the above bearish scenarios (refer 1stnutshell).

Please also be noted that mounting numbers of bearish risk reversals and bearish neutral RRs of the 3m tenors that are also in sync with the bearish scenarios refer to 2nd (RR) nutshell.

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the downside risks have been clear.

Accordingly, diagonal put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The execution of options strategy: Short 1m (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

The driving forces of the strategy: Contemplating all the above factors, we have advocated delta long puts for the long term on hedging grounds, comprising of more number of ITM long instruments and theta shorts with narrowed tenors for 1m shrinking IVs to optimize the strategy.

Theta shorts in OTM put option would go worthless and the premiums received from this leg would be sure profit. We would like to hold the same option strategy as stated above on hedging grounds. Thereby, deep in the money put option with a very strong delta will move in tandem with the underlying.Courtesy: Sentrix & Saxobank

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -110 levels (which is highly bearish), while hourly USD spot index was at 127 (highly bullish) while articulating (at 10:23 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure