EM Asian currencies were mixed versus the dollar during Wednesday’s Asian session. The SGD slid 0.3%, while the JPY gained slightly amid a 7 bp drop in the 10Y UST yield.

The CNH closed flat. Zhang Ming, an economist at the Chinese Academy of Social Sciences that is a top government think tank, said in remarks published on Wednesday that China's economic growth may drop to 5% or even lower due to the coronavirus outbreak. He added it will possibly push policymakers to introduce more stimulus measures. The KRW dipped somewhat Wednesday after tumbling 0.7% the previous session. USDKRW could consolidate at around 1,180 for now, following future movements in USDCNH. South Korea’s finance minister Hong Nam-ki on Wednesday told reporters that the government has no plan to draft extra budget related to the 2019 novel coronavirus. USDTWD is expected to rise towards 30.2 when onshore markets reopen Thursday after the Lunar New Year holidays.

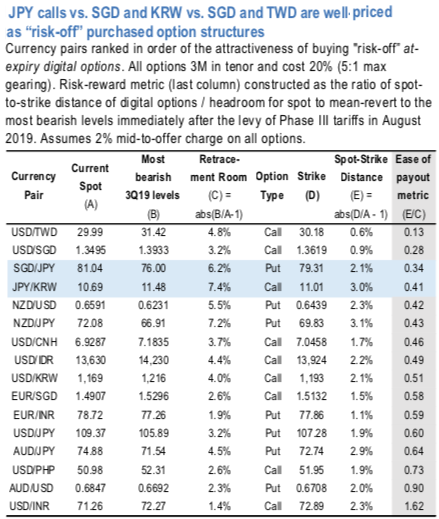

USDTWD calls screen as the best value in the region, but our preference is for JPY calls vs. SGD and KRW that have an established track record in stressed markets.

The above chart runs through an exercise of ranking the universe of Asian currency pairs in terms of the ease of triggering maximum payout on identically geared (5x payout) “risk- off” digital options, based on a comparison of their spot-to- strike distance with the headroom available for spot to revisit the most bearish levels immediately after the levy of Phase III tariffs in August 2019. USDTWD calls float to the top of the list due to a combination of low vol base and favorable forward points and can be a suitable risk management overlay for portfolios heavily invested in long TWD as a core view for 2020. As standalone hedges however, we are much more partial to JPY calls vs. SGD and KRW given a track record consistent delivery of JPY- crosses in stressed markets and a genuine pocket of correlation value in SGD/JPY in particular (JPY vs. SGD implied correlation is priced +15%, which is high compared to other EM/JPY correlations that are priced 0 or negative in most cases). Courtesy: JPM

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data