Jul 19, 2017 08:28 am UTC| Technicals

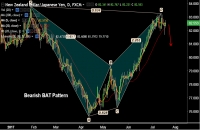

NZD/JPY has taken support at 20-DMA at 82.22 and edged higher to currently trade at 82.54 levels. Moving averages do not show signs of reversal as of now, price action rages between 5 and 20 DMAs. We see a...

FxWirePro: USD/CNY fails to find support below 6.75 mark, PBOC sets yuan mid-point at 6.7451

Jul 19, 2017 07:58 am UTC| Technicals

USD/CNY is currently trading around 6.7547 marks. It made intraday high at 6.7582 and low at 6.7449 levels. Intraday bias remains bullish till the time pair holds key support at 6.7450 mark. A sustained...

FxWirePro: EUR/AUD hovers around 100-DMA at 1.4548, bias lower, stay short

Jul 19, 2017 06:59 am UTC| Technicals

EUR/AUD has broken below daily Ichi cloud, intraday bias lower. The pair finds strong support at 100-DMA at 1.4548, we see scope for test of 200-DMA at 1.4387 on break below. Technical indicators are heavily...

FxWirePro: South African rand trades marginally lower ahead of CPI, core CPI data

Jul 19, 2017 06:50 am UTC| Technicals

USD/ZAR is currently trading around 12.93 levels. It made intraday high at 12.94 and low at 12.88 levels. Intraday bias remains neutral till the time pair holds key support at 12.88 mark. A daily close...

FxWirePro: Gold trades well above 200 –day MA, jump till $1258 likely

Jul 19, 2017 06:37 am UTC| Technicals

Gold jumped till $1244 on account of weak U.S dollar and falling U.S bond yields. The yellow metal formed a minor bottom around $1204 and any minor weakness can be seen only below that level. It is currently trading around...

FxWirePro: Nikkei Daily Outlook

Jul 19, 2017 06:35 am UTC| Technicals

Nikkei declined slightly below trend line support at 19936 and shown a minor recovery from that level. Nikkei is trading slightly weak on account of stronger yen. It is currently trading around 19983 0.02%...

Jul 19, 2017 06:30 am UTC| Technicals

Ever since the rejection of stiff resistance of 114.454 levels, the price behavior again goes in sloping channel, the price dips have again gone below 21DMA, for now, one can expect more dips upon bearish DMA crossover...

- Market Data