FxWirePro: USD/JPY breaks above 200-DMA, nears three-week high after poor Japan CPI, BOJ minutes

Mar 19, 2020 06:01 am UTC| Technicals Research & Analysis

USD/JPY chart - Trading View Fundamental Overview: USD/JPY is extending gains for the 3rd straight session, nears 3-week high above 109 handle. The major was trading 0.86% higher on the day at 108.95, edging lower...

FxWirePro: Gold trades weak on strong USD, good to sell on rallies

Mar 19, 2020 05:45 am UTC| Technicals

Ichimoku Analysis (4-hour chart) Tenken-Sen- $1513 Kijun-Sen- $1530 Gold is trading weak for the past two days on strong USD. DXY surged sharply and hits 3- year high at 101.74 on safe-haven demand....

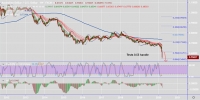

FxWirePro: AUD/USD fades RBA led bounce, extends slide to test 0.55 handle

Mar 19, 2020 04:52 am UTC| Technicals Research & Analysis

AUD/USD chart - Trading View Technical Analysis: Bias Strongly Bearish AUD/USD has erased early gains and has resumed weakness as Aussie bulls fade RBA and employment data led bounce. The major was trading 3.25%...

FxWirePro: USD/THB touches 32.74 mark in early Asian session; hits highest level since Dec 03, 2018

Mar 19, 2020 03:51 am UTC| Technicals

USD/THB is currently trading around 32.67 marks. It made intraday high at 32.74 and low at 32.48 marks. Intraday bias remains bullish till the time pair holds key support at 32.14 mark. On the top side, key...

Mar 19, 2020 03:33 am UTC| Technicals

USD/SGD is currently trading around 1.4539 marks. It made intraday high at 1.4543 and low at 1.4383 levels. Intraday bias remains bullish till the time pair holds key support at 1.4292 mark. A daily close...

Mar 19, 2020 02:22 am UTC| Technicals

USD/JPY is currently trading around 109.42 marks. It made intraday high at 109.49 and low at 107.84 levels. Intraday bias remains bullish for the moment. A daily close above 109.20 will take the parity...

FxWirePro: Aussie appreciates against major peers on robust employment change data

Mar 19, 2020 02:07 am UTC| Technicals

AUD/NZD is currently trading around 1.0140 marks. Pair made intraday high at 1.0161 and low at 1.0050 marks. Intraday bias remains bullish for the moment. A sustained close above 1.0100 will drag the parity...

- Market Data