FxWirePro- USDCHF Daily Outlook

May 26, 2022 08:25 am UTC| Technicals

Intraday resistance- 0.9650 Intraday support- 0.9600 USDCHF showed a minor pullback yesterday after hawkish US fed policy. The pair pared its gains as demand for safe-haven assets like the Swiss franc...

FxWirePro- GBPJPY Daily Outlook

May 26, 2022 08:20 am UTC| Technicals

GBPJPY has once again declined after a minor pullback above 200-4H MA. The pound sterling pared some of its gains after the hawkish Fed meeting minutes. The aftereffects of the Russia and Ukraine war, Covid spread in...

FxWirePro: USD/JPY holds marginal gains, US GDP and PCE eyed

May 26, 2022 04:57 am UTC| Technicals

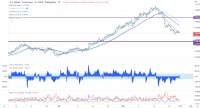

Chart - Courtesy Trading View USD/JPY was trading 0.11% higher on the day at 127.42 at around 05:50 GMT. The pair is holding marginal gains on the day after closing 0.40% higher in the previous session. DXY is...

May 26, 2022 04:53 am UTC| Technicals

Ichimoku Analysis (4-hours chart) Tenken-Sen- $1855.87 Kijun-Sen- $1851.07 Gold pared some of its gains after the hawkish Fed meeting minutes. It confirmed that the Central bank will hike rates by 50...

FxWirePro: GBP/NZD attracts buying interest, 38.2% fibonacci eyed

May 26, 2022 00:32 am UTC| Technicals

GBP/NZD initially declined on Wednesday after RBNZ raised interest rates but recovered sharply as investors reassessed the Bank of Englands (BOE) rate outlook. GBP/NZD initially dipped but found buyers at 1.9245,...

FxWirePro:GBP/AUD maintains bullish bias with focus on 1.7800

May 26, 2022 00:09 am UTC| Technicals

GBP/AUD gained on Wednesday as investors reassessed the Bank of Englands (BOE) rate outlook. Bulls have tightened their grip after registering a close above the 50%fib,scope grows for bigger gains towards 1.7800 ...

FxWirePro: EUR/AUD consolidating around 1.5060, bias is bullish

May 25, 2022 23:50 pm UTC| Technicals

EUR/AUD steadied on Wednesday as hawkish ECB rhetoric kept euro supported against Australian dollar. Price action shows consolidation of gains, 10-DMA poised to cross above 21-DMA, will be a bull signal once it...

- Market Data