FxWirePro: Daily Commodity Tracker - 18th October, 2022

Oct 18, 2022 11:13 am UTC| Technicals

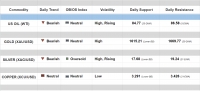

Daily Commodity...

FxWirePro: EUR/CHF finds stiff resistance at cloud top, break above required for upside continuation

Oct 18, 2022 10:24 am UTC| Technicals

Chart - Courtesy Trading View EUR/CHF was trading largely unchanged at 0.9785 at around 10:15 GMT. The pair is struggling at daily cloud top resistance, break above required for upside continuation. German ZEW...

FxWirePro: EUR/JPY Daily Outlook

Oct 18, 2022 10:03 am UTC| Technicals

Chart - Courtesy Trading View Spot Analysis: EUR/JPY was trading 0.06% higher on the day at 146.71 at around 09:45 GMT. Previous Weeks High/ Low: 144.84/ 140.89 Previous Sessions High/ Low: 146.71/...

FxWirePro- Top altcoins for the day (Strength index) (MATICUSD)

Oct 18, 2022 09:32 am UTC| Technicals Digital Currency

Pair Value Recommendation MATICUSD 421.59 Strong Buy Trends and levels to watch Pair Short-term trend Long-term trend Major resistance Major...

FxWirePro: AUD/NZD breaks below cloud, eyes 200-DMA

Oct 18, 2022 09:30 am UTC| Technicals

Chart - Courtesy Trading View - AUD/NZD was trading 0.67% lower on the day at 1.1090 at around 09:20 GMT - The pair has broken below daily cloud, is on track to test 200-DMA at 1.0975 - MACD and ADX support...

Oct 18, 2022 09:16 am UTC| Technicals

Pair Value Recommendation EURAUD 432.11 Strong Buy EURJPY 362.93 Strong Buy EURAUD Major resistance- 1.5700 Near-term support- 1.5580 Trend reversal...

FxWirePro- USDCHF Daily Outlook

Oct 18, 2022 09:06 am UTC| Technicals

USDCHF lost its shine on board based US dollars weakness. It formed a double top around 1.00735 and declined more than 100 pips. The policy divergence between the US fed and SNB supports the US dollar at lower levels. The...

- Market Data