EUR/AUD tending near upper channel line; Short on futures

Jun 01, 2015 06:14 am UTC| Insights & Views

Australian Q1 GDP largely reliant on domestic demand Building approvals only just off their all-time high Australian retail sales gulping down along steadily Unchanged rate decision almost a certainty - the strength of...

May 29, 2015 14:44 pm UTC| Insights & Views

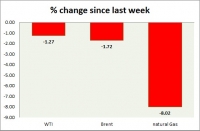

Energy pack is trading in green today. Weekly performance at a glance in chart table. Oil (WTI) - WTI has bounced back from $56.7 as crude stock surprisingly decreased for fourth consecutive week. WTI still remains...

May 29, 2015 14:28 pm UTC| Insights & Views

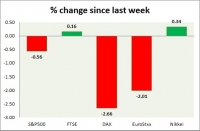

Equities are trading in red today. Performance this week at a glance in chart table - SP 500 - SP is down as US GDP components shrank and investors withdrew money from US. Headline GDP shrank by -0.7%. Chicago PMI...

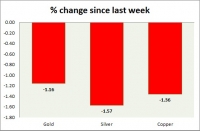

Commodities snapshot (precious & industrial)

May 29, 2015 14:07 pm UTC| Insights & Views

Metals are mixed today, precious is gaining while industrial falls. Performance this week at a glance in chart table - Gold - Gold is up but trading in small range of $1195-$1185 today. Bearish target is coming...

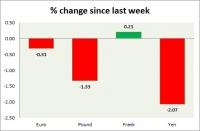

Currency snapshot (major pairs)

May 29, 2015 13:49 pm UTC| Insights & Views

Dollar index trading at 97 (+0.13%). Strength meter (today so far) - Euro +0.05%, Franc +0.25%, Yen -0.22%%, GBP -0.29% Strength meter (since last week) - Euro -0.16%, Franc +0.50%, Yen -1.95%, GBP -1.21% EUR/USD...

Cross hedging on INR (Short Futures + Long ATM Calls)

May 29, 2015 13:26 pm UTC| Insights & Views

The Indian currency is unlikely to depreciate much on account of improving current account deficit which is benefitting from low crude prices and reducing import volumes.On successful completion of 1 year steady governance...

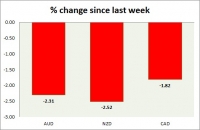

Currency snapshot (commodity pairs)

May 29, 2015 13:21 pm UTC| Insights & Views

Dollar index trading at 96.96 (+0.09%). Strength meter (today so far) - Aussie -0.18%, Kiwi -0.90%, Loonie -0.64%. Strength meter (since last week) - Aussie -2.31%, Kiwi -2.52%, Loonie -1.82%. AUD/USD - Trading at...

- Market Data