Aug 07, 2015 12:38 pm UTC| Insights & Views

If todays EUR/USD close breaches below 1.4311 then the drag until 1.4044 is certain, From last one month it is observed that the Euro Canadian pair has been moving in 2nd channel line band width of 270-280 pips. As shown...

Dollar technicals pointing to weakness ahead of NFP

Aug 07, 2015 11:51 am UTC| Insights & Views

Dollar is showing signs of weakness ahead of NFP, suggesting that data might either disappoint or Dollar might fail to break above its range and might succumb to testing the floor once more. FXCM US Dollar index is...

FxWirePro: Speculate EUR/USD via ATM binary calls ahead of NFP, target 20 pips

Aug 07, 2015 11:50 am UTC| Insights & Views

On verge of Non form payroll EUR/USDs vols are bolstering up close to 11%. As we could foresee some up swings on this pair is most likely, hence we reckon one touch at the money binary calls to fetch yields up to 15-20...

FxWirePro: Speculate EUR/USD via ATM binary calls ahead of NFP, target 20 pips

Aug 07, 2015 11:50 am UTC| Insights & Views

On verge of Non form payroll EUR/USDs vols are bolstering up close to 11%. As we could foresee some up swings on this pair is most likely, hence we reckon one touch at the money binary calls to fetch yields up to 15-20...

Aug 07, 2015 11:17 am UTC| Insights & Views

Today NFP report is to be published at 12:30 GMT from US. What is NFP report? NFP or non-farm payroll report is the monthly statistics on labor condition in the US released by US department of labor statistics. The...

FxWirePro: Option arbitrage for EUR/GBP as NPV of ATM calls indicates overpriced premiums

Aug 07, 2015 11:15 am UTC| Insights & Views

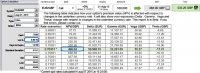

The near month volatility of ATM contracts of this the pair is at 9.15.Vols of 14D at the money calls - 8.90%NPV of this call - 468.04 while Premiums trading above 14.36% at GBP 535.26 for lot size 100,000 units.Hence,...

Political crisis deepens Ringgit rout

Aug 07, 2015 10:40 am UTC| Insights & Views

Malaysian Ringgit is facing relentless rout as investors pulls money out of the country ahead of a rate hike from US Federal Reserve. Moreover current political crisis has provided the acceleration to it. Even with low...

- Market Data