Oct 12, 2015 16:42 pm UTC| Insights & Views

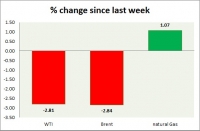

Energy pack is mixed, while oil pack is red, gas is trading in green today. Weekly performance at a glance in chart table. Oil (WTI) - WTI trimmed gains from 200 day moving average line since Friday. Todays range...

Commodities snapshot (precious & industrial)

Oct 12, 2015 16:32 pm UTC| Insights & Views

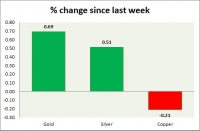

Metal pack is mixed, industrial is down and precious is trading green in todays trading. Performance this week at a glance in chart table - Gold - Gold gained further after breaking key $1152 area. Focus on $1168-70...

Oct 12, 2015 15:36 pm UTC| Insights & Views

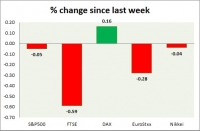

Equities are all red today. Kindly note all instruments mentioned here are CFDs, whose values might differ from cash or future traded. Performance this week at a glance in chart table - SP 500 - SP 500 is marginally...

Currency snapshot (commodity pairs)

Oct 12, 2015 15:25 pm UTC| Insights & Views

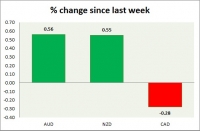

Dollar index trading at 94.78 (-0.10%) Strength meter (today so far) - Aussie +0.56%, Kiwi +0.55%, Loonie -0.28%. Strength meter (since last week) - Aussie +0.56%, Kiwi +0.55%, Loonie -0.28%. AUD/USD - Trading at...

Currency snapshot (major pairs)

Oct 12, 2015 15:15 pm UTC| Insights & Views

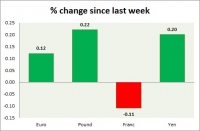

Dollar index trading at 94.75 (-0.12%). Strength meter (today so far) - Euro +0.12%, Franc -0.11%, Yen +0.20%, GBP +0.22% Strength meter (since last week) - Euro +0.12%, Franc -0.11%, Yen +0.20%, GBP +0.22% EUR/USD...

Renminbi series – Is capital flight over?

Oct 12, 2015 14:28 pm UTC| Insights & Views

Peoples bank of China (PBoC) this morning fixed the Yuan stronger against Dollar for seventh consecutive day, which makes it among the top 10 consecutive as well as strengthening move in the world. It is also Renminbis...

Riksbank to deal with catch 22 situations of currency depreciation, inflation and wage negotiation

Oct 12, 2015 13:37 pm UTC| Insights & Views Central Banks

Currency pressures The generally negative tone of risk for SEKs traditional status as a risk proxy. The apparent reversal of SEKs relationship with general risk appetite is largely a consequence of the fact it trades as...

- Market Data