Guide to today’s important data and events

Nov 04, 2015 06:49 am UTC| Insights & Views

Lot of economic dockets scheduled for today, all with low to medium risks associated. Data released so far - UK - BRC shop price index dropped -1.8% in October. Australia - Trade balance improved as imports grew...

Nov 03, 2015 14:38 pm UTC| Insights & Views

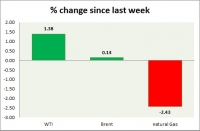

Energy pack is mixed, while gas is down oil is up. Weekly performance at a glance in chart table. Oil (WTI) - WTI recovered from its recent slump. Lack of clarity in outlook. Todays range $45.9-47.3 WTI is currently...

Nov 03, 2015 14:25 pm UTC| Insights & Views

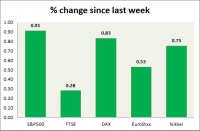

Equities are all in back foot today. Kindly note all instruments mentioned here are CFDs, whose values might differ from cash or future traded. Performance this week at a glance in chart table - SP 500 - SP 500 is...

Commodities snapshot (precious & industrial)

Nov 03, 2015 14:09 pm UTC| Insights & Views

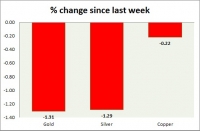

Metal pack is in red in todays trading. Performance this week at a glance in chart table - Gold - Gold is down for fourth consecutive day, and third consecutive week. Gold has reached target and now hovering at...

Currency snapshot (commodity pairs)

Nov 03, 2015 13:59 pm UTC| Insights & Views

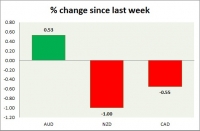

Dollar index trading at 97.27 (+0.37%) Strength meter (today so far) - Aussie +0.15%, Kiwi -0.80%, Loonie -0.37%. Strength meter (since last week) - Aussie +0.53%, Kiwi -1.00%, Loonie -0.55%. AUD/USD - Trading at...

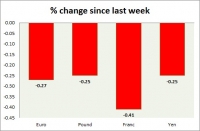

Currency snapshot (major pairs)

Nov 03, 2015 13:34 pm UTC| Insights & Views

Dollar index trading at 97.19 (+0.29%). Strength meter (today so far) - Euro -0.42%, Franc -0.38%, Yen -0.10%, GBP -0.31% Strength meter (since last week) - Euro -0.27%, Franc -0.41%, Yen -0.25%, GBP -0.25% EUR/USD...

European markets to look for cues in Draghi’s speech today

Nov 03, 2015 12:51 pm UTC| Insights & Views Central Banks

Euro as well as European bond and stock markets will look for cues on further ECB action in todays scheduled speech by European Central Bank (ECB) president Mario Draghi. After raising the possibility of further ECB...

- Market Data