After Trump's visit, Saudi Arabia hopes to reinforce its influence in the region, against Iran

Jun 01, 2017 13:30 pm UTC| Insights & Views

US President Donald Trumps visit to Saudi Arabia and his Islam speech, delivered at the Arab-Islamic-America Summit in Riyadh on May 21 2017, created controversy in the Muslim world. Iranian President Hassan Rouhani,...

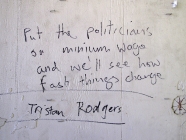

Young people are right to feel hard done by – pay discrimination for under 25s is legal

Jun 01, 2017 13:27 pm UTC| Insights & Views Law

Many of the university students graduating in the coming months are likely to feel short-changed when they start looking for jobs. Until they reach their 25th birthdays, and regardless of their qualifications, the minimum...

Jun 01, 2017 13:13 pm UTC| Insights & Views Economy

Next year will mark the 40th anniversary of the Love Canal crisis, when toxic chemicals were found to be leaking from an underground dump into homes in Niagara Falls, New York. State and federal agencies relocated more...

Brexit and the American Revolution: lessons for Liverpool's new metro mayor

Jun 01, 2017 13:06 pm UTC| Insights & Views Politics

Merseyside elected its first metro mayor in May. Steve Rotheram will now enjoy powers to integrate healthcare, housing, transportation and education among the areas local councils. But he is taking office in a turbulent...

The campaign to save Mexico's vaquita porpoise faces the same problems as the War on Drugs

Jun 01, 2017 12:59 pm UTC| Insights & Views Politics

Actor Leonardo DiCaprio recently took to social media to demand action to protect the endangered vaquita porpoise, a species native to the Gulf of California in Mexico that is on the verge of extinction. A week later, the...

Looking at buildings can actually give people headaches – here's how

Jun 01, 2017 12:47 pm UTC| Insights & Views Health

Its three oclock youre at work, struggling to focus during the afternoon lull. You gaze out of your office window, hoping for some relief, but instead you feel a headache coming on. Flat grey concrete lines the streets,...

Refugees welcome? How UK and Sweden compare on education for young migrants

Jun 01, 2017 12:45 pm UTC| Insights & Views

In the UK, the worlds fifth richest economy, vulnerable children are being denied education. Asylum seekers and refugee children are struggling to access education and unable to attend school or college. This contravenes...

- Market Data