Oct 03, 2017 09:15 am UTC| Research & Analysis Insights & Views

A possible bottoming out in inflation and the Fed repricing of a December hike are outright bearish and gold should rebase lower. To this end, the median Fed participant continues to look for one more hike this year (in...

FxWirePro: Glimpse through G10 and EMFX implied scenarios

Oct 03, 2017 08:38 am UTC| Research & Analysis Insights & Views

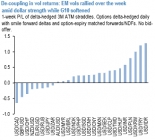

The dollar is seeing its fourth successive week of trade-weighted gains, mirroring a four-week gain in Treasury yields amid hopes of a tax-cutting fiscal package and expectations of a December Fed rate hike. We combine our...

Oct 03, 2017 05:56 am UTC| Research & Analysis Central Banks Insights & Views

Following on from last weeks hawkish comments from Bank of England policymakers in the recent past, we now expect a UK rate hike of 0.25% to be announced after the next Monetary Policy Committee meeting on November 2nd....

FxWirePro: Hedge USD/TRY risks via debit put spreads as Turkey posts mixed bag of fundamentals

Oct 02, 2017 18:20 pm UTC| Research & Analysis Insights & Views

Weve seen the trade and tourism data for August on Friday: the trade data highlight continuing widening of the trade deficit despite healthy export growth -- both exports and imports have accelerated visibly during the...

Oct 02, 2017 17:44 pm UTC| Research & Analysis Central Banks Insights & Views

It was just a few days ago when options stripthat was advocated to hedge AUDNZD during the New Zealand general election took place on Saturday 23 September 2017 to determine the membership of the52nd New Zealand...

Oct 02, 2017 15:10 pm UTC| Technicals Insights & Views

On daily terms, the stiff resistance is rejected at 1.1142 levels. That is where, weve already stated that the series of bearish pattern candlesticks, such as, Shooting stars, hanging man the bearish engulfing candles...

FxWirePro: Uphold costless EUR/SEK options combinations using AEDs

Oct 02, 2017 14:41 pm UTC| Research & Analysis Insights & Views

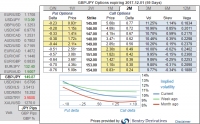

The FX option prices are not priced in the unambiguously positive asymmetry of Swedish Krona spot outcomes. Prices of at-expiry digital (AED) options would be construed as probabilities of spot ending at or beyond strike...

- Market Data