Comic-explainer: How does Islamic finance work?

Feb 20, 2018 07:40 am UTC| Insights & Views Economy

Interest fuels the financial world. The money sitting in your bank account accrues it, and the credit cards in your wallet charge it. If you ever want money quick, youre going to being paying a decent amount of interest...

Tesla's 'virtual power plant' might be second-best to real people power

Feb 20, 2018 07:24 am UTC| Insights & Views Technology

The South Australian government and Tesla recently announced a large-scale solar and storage scheme that will distribute solar panels and batteries free of charge to 50,000 households. This would form what has been...

Life on humanitarian compounds is removed from reality – this can fuel the misconduct of aid workers

Feb 20, 2018 07:18 am UTC| Insights & Views

Sexual harassment, exploitation or abuse some of which reportedly occurred at Oxfam in Haiti and has involved staff at other aid agencies elsewhere is never excusable. But the backdrop in which these sorts of acts occur...

Ramaphosa must fuse fixing broken institutions and economic policy

Feb 20, 2018 07:16 am UTC| Insights & Views Economy

The state of the nation speech delivered by South Africas new president Cyril Ramaphosa was designed to project an image of hope and change. The new head of state emphasised the fight against corruption, improved...

Thirty years since the Seoul Olympics, South Korea is still tackling the legacy of overseas adoption

Feb 20, 2018 07:12 am UTC| Insights & Views

South Korea holding this years Winter Olympics comes 30 years after the country first hosted the Summer Olympics, in the capital Seoul. It has undergone huge social changes since that time, but there is still a long road...

How artificial intelligence will transform how we gesture

Feb 20, 2018 07:07 am UTC| Insights & Views Technology

Over the last decade, the machine learning, which is part of artificial intelligence (AI), has given us self-driving cars, practical speech recognition, effective web search, and a vastly improved understanding of the...

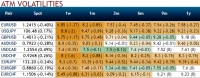

FxWirePro: Bullish/bearish scenarios, OTC indications and hedging perspectives of AUD/USD

Feb 20, 2018 06:57 am UTC| Research & Analysis Insights & Views

Bearish: AUDUSD below 0.76 if: 1) The unemployment rate moves back towards 5.75%, raising risks that the RBA responds to a weakening labour market; 2) The Fed responds to firm labour market outcomes and above trend...

- Market Data