U.S. likely to post weaker growth rate in Q3

Oct 27, 2015 05:15 am UTC| Commentary Central Banks

The FOMC is unexpected to give a strong indication about future policy. In light of the Feds professed data dependence and unwillingness to give formal forward guidance at this point-beyond simply saying that some further...

Limited manoeuvre in Poland's fiscal policy

Oct 27, 2015 05:13 am UTC| Commentary

Polands social-conservative opposition party Law Justice (PiS) won general elections. The shift in economic policy is expected after parliamentary election. However, any radical decision of the PiS is unlikely. The new...

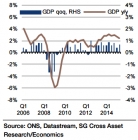

UK's GDP growth likely slowing in Q3

Oct 27, 2015 05:10 am UTC| Commentary

The first estimate of UKs Q3 growth will be the usual output estimate. The news from the high frequency data is that industrial production will make a very modest positive contribution to growth but that construction will...

Daily Economic Outlook: 27th October, 2015

Oct 27, 2015 05:08 am UTC| Commentary

In advance of Wednesdays FOMC meeting and Thursdays Q3 GDP data, US durable goods orders for September will provide an update on US manufacturing. Recent statistics have suggested that activity in this area, which is much...

Euro area money supply growth to increase to 5.0% yoy after August dip

Oct 27, 2015 05:07 am UTC| Commentary

The main driver for slowing of money supply growth in the Euro area is the Eurosystem. Credit to governments from MFIs (which bought 48bn of government bonds in August) contributed 2.2pp to the 4.8% yoy M3 growth, most of...

US durable goods orders likely to slump further

Oct 27, 2015 05:02 am UTC| Commentary

Pared by an aircraft-led drop in transportation equipment requisitions, US durable goods orders probably contracted by 2.5% last month, eclipsing the 2.3% falloff posted in August. Reflecting a projected 81.5% dive in...

Fed's rate hike unlikely before 2016

Oct 27, 2015 04:59 am UTC| Commentary

For the October FOMC meeting, markets and the Fed are reasonably well aligned. Markets do not appear to expect the Fed to hike, andthe Fed will stand pat. However, market pricing diverges sharply from Fed communications...

- Market Data