US Q4 GDP tracking 2.1% after October factory orders

Dec 03, 2015 15:56 pm UTC| Commentary

Total factory orders rose 1.5 m/m in October, close to forecast and consensus expectations of a 1.4% gain. October orders for durable goods were revised down a touch, to 2.9% m/m (initial: 3.0%), and continue to reflect...

Super Mario’s stimulus disappoints Euro currency surges

Dec 03, 2015 15:54 pm UTC| Commentary

ECB President Mario Draghi expanded monetary stimulus but its markets wanted more and a lot more. The ECB dropped an already negative deposit rate further by -10 basis points and extended its QE program until March 2017,...

US ISM nonmanufacturing index falls more than expected in November

Dec 03, 2015 15:47 pm UTC| Commentary

The ISM nonmanufacturing index declined to 55.9 in the November print (previous: 59.1), a sharper decline than both forecast (58.0) and the consensus (58.0) expectation. Business activity fell to 58.2 (previous: 63.0), and...

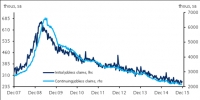

US jobless claims at solid levels ahead of November employment report

Dec 03, 2015 15:33 pm UTC| Commentary

Initial jobless claims rebounded to 269k in the week ending November 28 (previous: 260k), in line with forecast and consensus expectations. The four-week moving average of initial claims ticked down to 269k from 271k the...

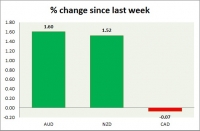

Currency snapshot (commodity pairs)

Dec 03, 2015 15:31 pm UTC| Commentary

Dollar index trading at 100.32 (+0.48%) Strength meter (today so far) - Aussie +0.01%, Kiwi -0.25%, Loonie -0.23%. Strength meter (since last week) - Aussie +1.60%, Kiwi +1.52%, Loonie -0.07%. AUD/USD - Trading at...

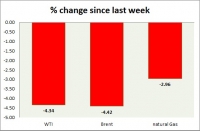

Dec 03, 2015 15:23 pm UTC| Commentary

Energy pack is mixed, while oil is up, gas is in red today. Weekly performance at a glance in chart table. Oil (WTI) - WTI is up as Saudi Arabia showed openness to production cut but not alone. Todays range...

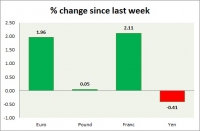

Currency snapshot (major pairs)

Dec 03, 2015 15:19 pm UTC| Commentary

Dollar index trading at 98.75 (-1.26%). Strength meter (today so far) - Euro +1.89%, Franc 1.30%, Yen -0.07%, GBP +0.57% Strength meter (since last week) - Euro +1.96%, Franc +2.11%, Yen -0.41%, GBP +0.05% EUR/USD...

- Market Data