Currency snapshot (major pairs)

Dec 23, 2015 13:46 pm UTC| Commentary

Dollar index trading at 98.36 (+0.15%). Strength meter (today so far) - Euro -0.32%, Franc -0.30%, Yen +0.10%, GBP +0.51% Strength meter (since last week) - Euro +0.48%, Franc +0.04%, Yen +0.18%, GBP +0.05% EUR/USD...

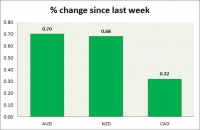

Currency snapshot (commodity pairs)

Dec 23, 2015 13:35 pm UTC| Commentary

Dollar index trading at 98.31 (+0.10%) Strength meter (today so far) - Aussie -0.13%, Kiwi -0.48%, Loonie +0.05% Strength meter (since last week) - Aussie +0.70%, Kiwi +0.68%, Loonie +0.32% AUD/USD - Trading at...

OPEC Suggests Oil-Price Rebound, Warns Declining Investment

Dec 23, 2015 12:51 pm UTC| Commentary

Oil producing nations cartel OPEC has revised its demand estimate in its latest World Oil Outlook, however has warned over declining investments. OPEC demand projections are still higher than those projected by...

API reports deficit, while WTI awaits EIA report – calls updated

Dec 23, 2015 12:18 pm UTC| Commentary

WTI is continuing its downward slide, only hindered by profit booking to counter sellers at rallies. Export ban lift hasnt boosted price either amid supply glut. Key factors at play in Crude market - US lawmakers...

US personal consumption expenditure preview

Dec 23, 2015 12:04 pm UTC| Commentary Economy

Personal consumption, income data along with PCE price index would be released from US at 13:30 GMT. Why it matters? Personal consumption and income data provide information on consumer sentiment. Consumers tend...

Worrisome Signs Series – is IP indicating impending recession in US

Dec 23, 2015 10:59 am UTC| Commentary

US Federal Reserve hiked rates last week, being confident over US economy and growth ahead. However Industrial production in US may not be in agreement with the FED. This yearly growth chart of Industrial production...

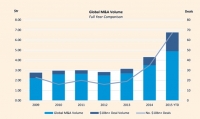

Worrisome Signs Series – Record mergers and acquisitions worrisome

Dec 23, 2015 10:11 am UTC| Commentary

Mergers and Acquisition tend to pick up pace and reach its heights around stock market peak. So it works as a contrarian indicator. Managers and acquirer are most optimist around stock market peak. So this years record...

- Market Data