Currency snapshot (commodity pairs)

Jan 26, 2016 11:32 am UTC| Commentary

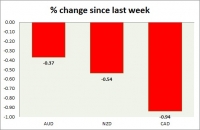

Dollar index trading at 99.41 (+0.14%) Strength meter (today so far) - Aussie +0.47%, Kiwi +0.19%, Loonie +0.32% Strength meter (since last week) - Aussie -0.37%, Kiwi -0.54%, Loonie -0.94% AUD/USD - Trading at...

Commodities snapshot (precious & industrial)

Jan 26, 2016 11:24 am UTC| Commentary

Metal pack is mixed today. Performance this week at a glance in chart table - Gold - Gold is up in the face of risk aversion. Todays range $1106-1117 Gold is currently trading at $1112/troy ounce. Immediate support...

Jan 26, 2016 11:17 am UTC| Commentary

Energy pack is up today. Weekly performance at a glance in chart table. Oil (WTI) - WTI dropped further, but recovered and now trading around $30/barrel. Todays range $30.5-29.3 WTI is currently trading at...

FxWirePro: Long term outlook – Pound might drop to 121 against Yen

Jan 26, 2016 10:48 am UTC| Commentary

Pound is currently trading at 167.8 against Yen and we expect it to drop further. Our previous call (Sell Pound at 186 against Yen, targeting 180.4, 179 and 176) reached target and beyond. Though one could have followed on...

Sweden's Riksbank likely to cut rates by 10bp in February

Jan 26, 2016 10:46 am UTC| Commentary Central Banks

Swedish producer prices have witnessed a downward trend since May 2015, due to lower prices for commodities and petroleum products. The downward trend continues as December producer prices dropped by -0.7 percent m/m and...

ECB’s improving credit provisions likely to provide growth momentum in 2016

Jan 26, 2016 10:22 am UTC| Commentary Central Banks

Declining bank lending and tightening lending standards weighed on Eurozones growth during the sovereign crisis. However, with gradual increase in bank lending and easing lending standards, the growth has moderately...

FxWirePro: Long term outlook – Euro could rise another 800 points against Pound

Jan 26, 2016 10:20 am UTC| Commentary

Since 2013, expectations of monetary policy divergence has pushed Euro lower against Pound from 0.87 area to as low as 0.69. 2013/14 was a time, when Bank of England (BOE) was expected to move first ahead of FED in hiking...

- Market Data