Russian bonds slump on tracking weak oil prices

Apr 05, 2016 08:00 am UTC| Commentary

The Russian bonds declined, pushing the yield on 10-year bonds up 3 bps to 9.22 pct, tracking weak crude oil prices on Tuesday. Moreover, Brent crude oil, a global benchmark for Russias main export, was down 0.93 pct at...

RBA keeps cash rate on hold, unlikely to change rate throughout 2016

Apr 05, 2016 07:46 am UTC| Commentary

The Reserve Bank of Australia kept the cash rate on hold at 2%, on par with expectations. The central banks statement was largely optimistic on the global and domestic economies outlook. The central bank seems relieved...

S. Korean bonds fall after BoK dovish comments

Apr 05, 2016 07:45 am UTC| Commentary

The South Korean 10-year bond prices slumped on Tuesday after Bank of Koreas policy board has played down expectations that the bank would resort to quantitative easing to boost the countrys flagging economy. The benchmark...

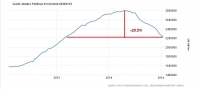

Oil in Global Economy Series: Saudi Arabia bleeds reserve amid lower oil

Apr 05, 2016 07:19 am UTC| Commentary

Saudi Arabias pains are visibly on the rise as the economy facing threats of downgrades, if it fails to check on its ballooning fiscal deficit, which is projected to be 15-16% of GDP this year. In a separate article, we...

Revisions to US factory orders impact Q1 spending outlook, inventories to be drag on Q1 GDP growth

Apr 05, 2016 07:00 am UTC| Commentary

The previous advance manufacturing report had showed that durable goods orders in February had declined. However, the drop in durable goods orders has been revised to 3% from the initial estimate of 2.8%. Furthermore, most...

Indian long-term bonds rally after RBI rate cut

Apr 05, 2016 06:44 am UTC| Commentary

The Indian long-term bonds rallied on Tuesday as the Reserve Bank of India reduced its policy rate by 25 bps to 6.50 pct. The benchmark 10-year bonds yield, which is inversely propositional to bond price fell to 4 bps to...

RBI tweaked policy in a first time ever fashion

Apr 05, 2016 06:33 am UTC| Commentary Central Banks

Today, Reserve Bank of India, Governor Raghuram Rajan, tweaked policy in an unprecedented way by reducing repo rates, at which banks borrow and increasing reverse repo rates, the rates banks get while depositing excess...

- Market Data