FxWirePro: EUR/AUD IVs Tepid as RBA likely to replicate ECB- stay with Backspread

Apr 26, 2016 11:59 am UTC| Commentary

There is rarely a time when you need to act quickly and constantly to earn consistent money. The ECB has indicated an extra relaxation in monetary policy at its upcoming meeting day after tomorrow. But during Decembers...

U.S. Presidential Election Series: Trump’s Wall stands in his own way to nomination

Apr 26, 2016 11:58 am UTC| Commentary

One of the key cornerstone of Donald Trumps policy has been The Wall. You may like it or hate it but cant just ignore the idea. Mr. Trump has promised that he will be building a wall along Mexico border to prevent illegal...

Euro area money supply growth likely accelerated in March

Apr 26, 2016 11:20 am UTC| Commentary

Euro areas M3 money supply growth is likely to have accelerated to 5.3% y/y last month, according to Societe Generale. In February, the currency blocs M3 money supply had grown 5% y/y, where credit to governments from MFIs...

More century bonds to follow from Europe

Apr 26, 2016 11:12 am UTC| Commentary

Expect more. Ireland was the first European country to launch a century bond in late March. The country issued its first 100 year note at 2.35% yield. The issue was privately placed worth 100 million and was handled by...

Russian bonds flat ahead of Central Bank of Russia’s policy meeting

Apr 26, 2016 10:54 am UTC| Commentary

The Russian bonds were trading nearly flat on Tuesday as investors await Central bank of Russia (CBR) monetary policy meeting. The benchmark 10-year bonds yield, which is inversely proportional to the price of bonds, stood...

Developing Asia continues to be net capital importer

Apr 26, 2016 10:53 am UTC| Commentary

Along with the rest of the world, developing Asian nations have a current account surplus. This also indicates that it has foreign financial assets, noted KfW Research. In 2014, this build-up of assets from the rest of the...

FOMC to avoid making clear risk assessment, signifying extended policy pause

Apr 26, 2016 10:23 am UTC| Commentary

The US Fed, during its FOMC meeting that ends tomorrow, is not expected to hike rates. The FOMC is likely to avoid making a clear risk assessment again, signifying extended policy pause, according to Nordea Bank. However,...

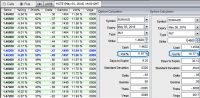

- Market Data