Jul 15, 2016 13:14 pm UTC| Commentary

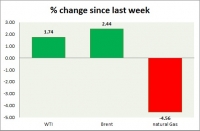

Energy pack is up in todays trading. Weekly performance at a glance in chart table. Oil (WTI) WTI is up on risk affinity, positive for the week. Active call WTI is likely to drop towards $35 area. Todays range...

Commodities snapshot (precious & industrial)

Jul 15, 2016 13:06 pm UTC| Commentary

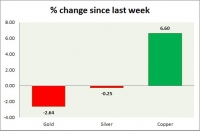

Metal pack is mixed today. Performance this week at a glance in chart table - Gold: Gold is worst performer of the week as risk affinity is on the rise. Todays range $1326-1337 We expect gold to reach...

US Treasuries complex slump on firm economic data

Jul 15, 2016 13:01 pm UTC| Commentary

The US Treasuries complex saw selling across the curve on Friday after reading firmer consumer price and retail sales. Also, stronger-than-expected producer prices data for June, coupled with maintained improvement in...

GBP to remain under pressure in short-term to medium-term on uncertainty in UK

Jul 15, 2016 12:58 pm UTC| Commentary

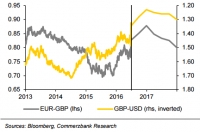

The outlook of GBP continues to be extremely uncertain unless it is evident how things would unfold in the UK. The sterling faces a risk of further depreciation, especially against the US dollar as it is in demand as a...

Currency snapshot (commodity pairs)

Jul 15, 2016 12:58 pm UTC| Commentary

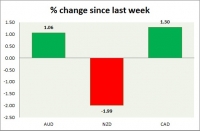

Dollar index trading at 96.2 (+0.09%) Strength meter (today so far) Aussie +0.33%, Kiwi -0.17%, Loonie +0.21% Strength meter (since last week) Aussie +1.06%, Kiwi -1.99%, Loonie +1.30% AUD/USD Trading at...

Currency snapshot (major pairs)

Jul 15, 2016 12:53 pm UTC| Commentary

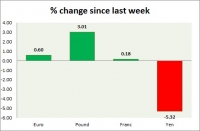

Dollar index trading at 96.2 (+0.09%) Strength meter (today so far) Euro +0.06%, Franc +0.04%, Yen -0.81%, GBP -0.2% Strength meter (since last week) Euro +0.60%, Franc +0.18%, Yen -5.32%, GBP +3.01% EUR/USD...

Norges Bank likely to ease policy on subdued growth outlook

Jul 15, 2016 12:49 pm UTC| Commentary Central Banks Economy

Norways central bank, Norges Bank, is banking on an expansionary monetary policy, owing to subdued growth outlook. The Norwegian central bank has cut its key interest rate by 100 basis points to current 0.5 percent since...

- Market Data