UK’s inflation beats expectations, buoyed by rising airfares and higher oil prices

Jul 19, 2016 14:01 pm UTC| Commentary

Data released by the Office for National Statistics earlier on Tuesday showed the UK inflation accelerated more than forecast in June buoyed by rising airfares and higher oil prices. Data showed that UK inflation picked up...

RBNZ proposes new LVR restrictions to mitigate risks from overheating of real estate

Jul 19, 2016 13:37 pm UTC| Commentary

RBNZ proposed to broaden the loan-to-value restrictions currently in place in Auckland to the rest of the nation in an effort to mitigate risks from financial stability stemming from property overheating. The change would...

Jul 19, 2016 13:16 pm UTC| Commentary

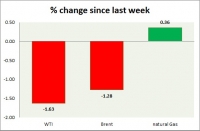

Energy pack is up in todays trading. Weekly performance at a glance in chart table. Oil (WTI) WTI is up today but likely to go down further. Active call WTI is likely to drop towards $35 area. Todays range...

Canadian bonds strengthen on weak crude oil prices; inflation data eyed

Jul 19, 2016 13:03 pm UTC| Commentary

The Canadian government bonds strengthened on Tuesday, following weak crude oil prices. Also, investors await wholesale and consumer inflation data, scheduled to be released on July 21-22. The yield on the benchmark...

Jul 19, 2016 12:56 pm UTC| Commentary

German HICP inflation is likely to continue improving in July for the third consecutive time. According to a Societe Generale research report, the HICP inflation is likely to reach 0.3 percent year-on-year in July. Energy...

US housing starts beat expectations in June, housing demand strengthens in Q2

Jul 19, 2016 12:53 pm UTC| Commentary

The United States housing starts rose during the month of June, beating market expectations due to a broad rise in the countrys construction activity. This signaled that the nations home building is gaining importance into...

Commodities snapshot (precious & industrial)

Jul 19, 2016 12:46 pm UTC| Commentary

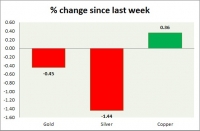

Metal pack is mixed today. Performance this week at a glance in chart table - Gold: Gold is up on risk aversion, may go down a bit further but likely to find support around $1300 area. Todays range...

- Market Data