China’s housing demand to stay resilient through 2030 despite short-term volatility - Fitch

Aug 08, 2016 14:12 pm UTC| Commentary Real Estate

According to a Fitch Ratings report released on Monday, Chinas property market will remain relatively resilient over the next 15 years through 2030. Fitch study claims Chinas housing demand will remain underpinned by...

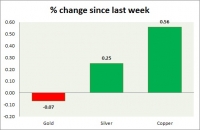

Commodities snapshot (precious & industrial)

Aug 08, 2016 13:33 pm UTC| Commentary

Metal pack is down today. Performance this week at a glance in chart table - Gold: Gold is marginally down today. Todays range $1329-1338 We expect gold to reach $1520 Gold is currently trading at $1334/troy...

China's trade data continues to point to weak external demand

Aug 08, 2016 13:32 pm UTC| Commentary

Customs China released their latest report on the Chinese trade which showed that the countrys trade surplus and exports bettered expectations, while imports surprised to the downside. China trade balance for July came in...

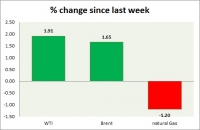

Aug 08, 2016 13:25 pm UTC| Commentary

Energy pack is mixed in todays trading. Weekly performance at a glance in chart table. Oil (WTI) WTI gained sharply on the news that the OPEC members will be holding an informal meeting next month. Active call ...

Mexican inflation likely to have accelerated to 2.74 pct in July

Aug 08, 2016 13:19 pm UTC| Commentary

The rise in bi-weekly inflation in Mexico to 2.72 percent year-on-year from 2.53 percent in July is mainly due to the uptick in non-core government approved energy prices, said Societe Generale in a research report. Thus,...

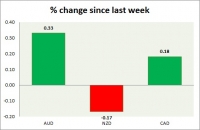

Currency snapshot (commodity pairs)

Aug 08, 2016 13:02 pm UTC| Commentary

Dollar index trading at 96.37 (+0.11%) Strength meter (today so far) Aussie +0.33%, Kiwi -0.17%, Loonie +0.18% Strength meter (since last week) Aussie +0.33%, Kiwi -0.17%, Loonie +0.18% AUD/USD Trading at...

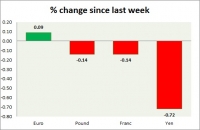

Currency snapshot (major pairs)

Aug 08, 2016 12:52 pm UTC| Commentary

Dollar index trading at 95.74 (+0.22%) Strength meter (today so far) Euro +0.09%, Franc -0.14%, Yen -0.72%, GBP -0.14% Strength meter (since last week) Euro +0.09%, Franc -0.14%, Yen -0.72%, GBP -0.14% EUR/USD...

- Market Data