FxWirePro: The Day Ahead- 23rd August, 2016

Aug 23, 2016 02:52 am UTC| Commentary Economy

Lots of economic dockets and events are scheduled for today and all with low volatility risks associated. Data released so far: China: MNI business sentiment declined in August to 54.3 from 55.5 prior. Japan:...

Asian markets mixed, gold stabilises above $1,330

Aug 23, 2016 02:46 am UTC| Commentary

Asian indices were trading on a mixed note on the 2nd consecutive day. On the other side, gold was slightly down and was trading around $1,337 marks. Silver was trading around $18.96 levels. Japans Nikkei 225 was...

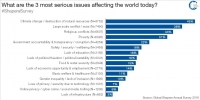

Chart of the Day: Global concerns

Aug 22, 2016 16:29 pm UTC| Commentary

This fantastic chart shared by World Economic Forum showed what are the biggest worries of the world. Surprisingly, Climate change came at the first spot as the biggest concern right now. Given the number of active...

China's rapidly rising housing leverage poses new risks in the event of a housing correction

Aug 22, 2016 15:53 pm UTC| Commentary

Though moderating, Chinas housing market this year has remained strong. Chinas home sales were still up 26.4 percent y/y in the first seven months. Despite the governments explicit voicing of housing bubble...

Soaring fuel exports from China add to downward pressure on oil prices

Aug 22, 2016 14:59 pm UTC| Commentary

Chinas customs data released on Monday showed that Chinas diesel, gasoline and kerosene exports surged in July from a year earlier. Data showed that Chinas Diesel exports rose 181.8 percent to 1.53 million tonnes, gasoline...

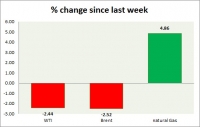

Aug 22, 2016 14:58 pm UTC| Commentary

Energy pack is up in todays trading. Weekly performance at a glance in chart table. Oil (WTI) WTI is down today after big rise last week. Todays range $47.6-49 WTI is currently trading at $47.9/barrel....

Kuroda sees room for further rate cuts below zero, possibly in September

Aug 22, 2016 14:28 pm UTC| Commentary

In an interview over the weekend to the Sankei newspaper, Bank of Japan (BoJ) Governor Haruhiko Kuroda said there is sufficient chance of more easing at next months policy meeting. The phrasing was different from the usual...

- Market Data