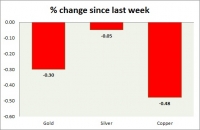

Commodities snapshot (precious & industrial)

Aug 30, 2016 16:04 pm UTC| Commentary

Metal pack is down today. Performance this week at a glance in chart table - Gold: Gold is down as rate hike as both equities and the dollar move higher. Todays range $1315-1325 We expect gold to reach...

Economic and business confidence in the Eurozone tumble abruptly in August

Aug 30, 2016 15:44 pm UTC| Commentary Economy

Data released by the European Commission earlier on Tuesday showed that economic sentiment in the Eurozone edged lower in August. The Economic Sentiment Indicator for the month fell marginally to 103.5 from the July figure...

New Zealand July building consents partly reverse previous month's surge, strengthening trend intact

Aug 30, 2016 15:28 pm UTC| Commentary

New Zealand building consents took a breather in July following a surge in the previous month, but remained on a strengthening trend. Data released by Statistics New Zealand earlier on Tuesday showed that New Zealand...

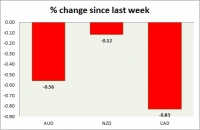

Currency snapshot (commodity pairs)

Aug 30, 2016 15:00 pm UTC| Commentary

Dollar index trading at 95.9 (+0.33%) Strength meter (today so far) Aussie -0.82%, Kiwi -0.48%, Loonie -0.56% Strength meter (since last week) Aussie -0.56%, Kiwi -0.12%, Loonie -0.83% AUD/USD Trading at...

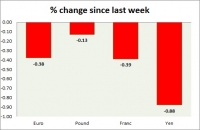

Currency snapshot (major pairs)

Aug 30, 2016 14:50 pm UTC| Commentary

Dollar index trading at 95.99 (+0.43%) Strength meter (today so far) Euro -0.40%, Franc -0.41%, Yen -0.86%, GBP +0.01% Strength meter (since last week) Euro -0.38%, Franc -0.39%, Yen -0.88%, GBP -0.13% EUR/USD...

U.K. credit demand slows, July mortgage approvals lowest since Jan 2015

Aug 30, 2016 14:31 pm UTC| Commentary

UK consumer credit growth showed signs of cooling in July, the month after the vote to leave the European Union. Bank of England data released earlier on Tuesday showed that UK consumer credit, which includes credit cards...

UK inflation expectations hit highest level in more than two years

Aug 30, 2016 14:19 pm UTC| Commentary Economy

Inflation expectations in the UK have hit the highest point since 2014, now the worry is will the actual inflation follow or will it just remain subdued as it did since 2014. The market as of now pricing that there would...

- Market Data