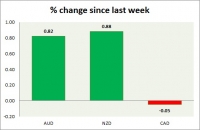

Currency snapshot (commodity pairs)

Jan 09, 2017 13:49 pm UTC| Commentary

Dollar index trading at 102.22 (-0.02%) Strength meter (today so far) Aussie +0.82%, Kiwi +0.88%, Loonie -0.05% Strength meter (since last week) Aussie +0.82%, Kiwi +0.88%, Loonie -0.05% AUD/USD Trading at...

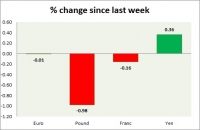

Currency snapshot (major pairs)

Jan 09, 2017 13:43 pm UTC| Commentary

Dollar index trading at 102.45 (+0.21%) Strength meter (today so far) Euro -0.01%, Franc -0.16%, Yen +0.36%, GBP -0.98% Strength meter (since last week) Euro -0.01%, Franc -0.16%, Yen +0.36%, GBP -0.98% EUR/USD...

Worrisome Signs Series: High corporate debt levels and rate hikes from Fed

Jan 09, 2017 13:19 pm UTC| Commentary Economy

When the Federal Reserve says that they are going to hike rates by as much as 75 basis points, the one thing that should worry every investor is the level of debts gorged by companies since the Great Recession of...

Briferendum Aftermath Series: Single market access not the redline

Jan 09, 2017 12:40 pm UTC| Commentary

British Prime Minister Theresa May and her government have indicated that they would trigger the Article 50 by the end of March this year, which would formally trigger the exit process from the British membership of the...

Canadian bonds surge following soggy energy prices; TSX to open weak

Jan 09, 2017 12:39 pm UTC| Commentary

The Canadian bonds surged Monday as investors poured into safe-haven assets on the back of weakness in global energy prices. The yield on the benchmark 10-year bond, which moves inversely to its price, plunged nearly 5...

China’s producer price index likely to have accelerated sharply in December

Jan 09, 2017 12:25 pm UTC| Commentary

Chinas producer price index is likely to have accelerated sharply in December. According to a Societe Generale research report, PPI is expected to have increased further to more than 5 percent year-on-year in December from...

U.S. Treasuries gain ahead of FOMC members’ speech, weak energy prices lend support

Jan 09, 2017 12:20 pm UTC| Commentary

The U.S. Treasuries gained Monday as investors remain cautious ahead of the Federal Open Market Committee (FOMC) members speech later in the day. Also, weakness in global crude oil prices lent support to the U.S. debt...

- Market Data