Jul 28, 2016 08:06 am UTC| Research & Analysis Insights & Views Central Banks

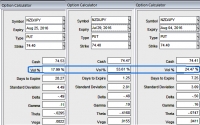

The implied volatilities of ATM contracts for near month expiries of this the pair are spiking in sky-rocketed pace. Here are the evidences: ATM IVs of this pair is trending higher at around 53.61%, 17.99% and 24.47%...

Fundamental Evaluation Series: EUR/USD vs. yield divergence review

Jul 28, 2016 07:41 am UTC| Commentary Central Banks Economy

The chart above shows, how the relationship between EUR/USD and 2-year yield divergence has unfolded since 2012. It is evident that these short rates have been akey influencing factor for the pair as policy divergence...

FxWirePro: Spill-over effects of Brexit, who to hedge long and shorts Brexit

Jul 28, 2016 05:56 am UTC| Insights & Views Central Banks

What drive GBP hedging for further downside risks: Despite UK GDP prints managed to post better than forecasted numbers, actual 0.6% versus forecasts at 0.5% and previous 0.4%, the UK growth outlook has been hit by...

FOMC monetary policy July 2016: Assessing future bias

Jul 28, 2016 05:29 am UTC| Commentary Central Banks

Yesterday, FOMC policymakers preferred to keep policy steady and not go for a hike. This was somewhat expected given the risks arising from the British referendum. There are not enough evidence yet to make a...

FOMC maintains hawkish tone, keeps Fed funds rate unchanged

Jul 28, 2016 05:28 am UTC| Commentary Central Banks

The Federal Reserve Open Market Committee maintained a hawkish tone at the monetary policy meeting held Wednesday, while keeping the Federal Funds Rate unchanged. However, the Feds statement kept hopes alive for a rate cut...

Jul 27, 2016 12:35 pm UTC| Research & Analysis Insights & Views Central Banks

The GBP versus a few major G10 currencies on Wednesday, despite upbeat Q2 GDP numbers, as the investors seem to have remained cautious ahead of the Feds monetary policy statement due later in the day and the Bank of...

Sterling against few majors shrugs off growth, Does BoE factor in Q2 GDP for rate cuts?

Jul 27, 2016 12:14 pm UTC| Insights & Views Central Banks

GBP crosses seem to have neglected the British GDP data which is better than expected, actual 0.6% versus forecasts at 0.5% and previous 0.4%. GBP versus a few major G10 currencies are losing after better than expected...

- Market Data