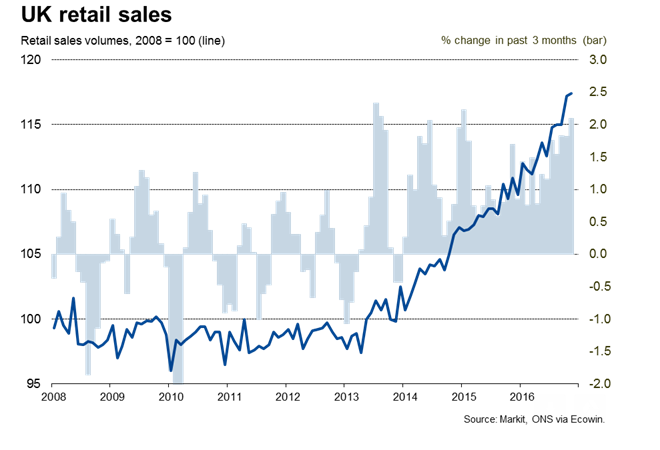

Data from the Office for National Statistics (ONS), showed on Friday that U.K. retail sales volumes unexpectedly dropped by 0.3 percent compared with the previous month, widely missing analysts expectations for a 0.9 percent rise. Compared with January 2015, sales were up 1.5 percent, the weakest performance since November 2013.

Details of the report suggested higher fuel and food prices were key factors contributing to the slowdown. Data is consistent with the message from various private sector surveys such as those of BRC and CBI, along with John Lewis sales that retail spending in the first few weeks of 2017 has been lacklustre. Analysts expect further slowing in consumer spending as rising inflation is set to further eat into real wages this year.

Data released earlier this week showed UK inflation rose more than expected in November, with further upward pressure likely to appear in coming months. Expensive clothing and the impact of June’s Brexit vote on the prices paid by consumers for technology goods pushed UK's inflation to more than two-year high in November. Data released on Tuesday by the Office for National Statistics showed UK consumer prices rose 1.2 percent compared with a year ago, beating economists’ expectation for a 1.1 percent annual rise.

"A sharp turnaround in the inflation environment has put a sharp brake on the growth of retail spending - and we are likely to see more of the same as we move through 2017 and next year," said Andrew Sentance, senior economic adviser at PwC.

Bank of England (BoE) forecasts that inflation would surge to about 2.8 percent by mid-2018, as sterling's slump after Brexit vote pushes up the cost of imports. November's data clearly underscores how inflation in Britain looks set to rise sharply next year. BoE Governor Mark Carney has said the central bank could tolerate some overshoot against its inflation target, to help accommodate economic growth and employment. A BoE survey earlier this month showed Britons expect a sharp rise in inflation over the coming year which has raised expectations that a hike in interest rates is on the way.

"Today’s data alongside the report of slower wage growth released earlier this week will only reinforce the concerns of the majority on the Bank of England’s rate-setting committee that there are downside risks to economic growth, as well as upside risks to inflation that need careful monitoring." said Lloyds Bank in a report.

FTSE 100 falters and Cable slumps to hit lows of 1.2387 as U.K. retail sales show unexpected fall. FxWirePro's Hourly GBP Spot Index was also bearish at -76.1494 at 1220 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  South Korea Inflation Hits Five-Month Low as CPI Reaches Central Bank Target

South Korea Inflation Hits Five-Month Low as CPI Reaches Central Bank Target  Asian Markets Wobble as AI Fears Rattle Stocks, Oil and Gold Rebound

Asian Markets Wobble as AI Fears Rattle Stocks, Oil and Gold Rebound