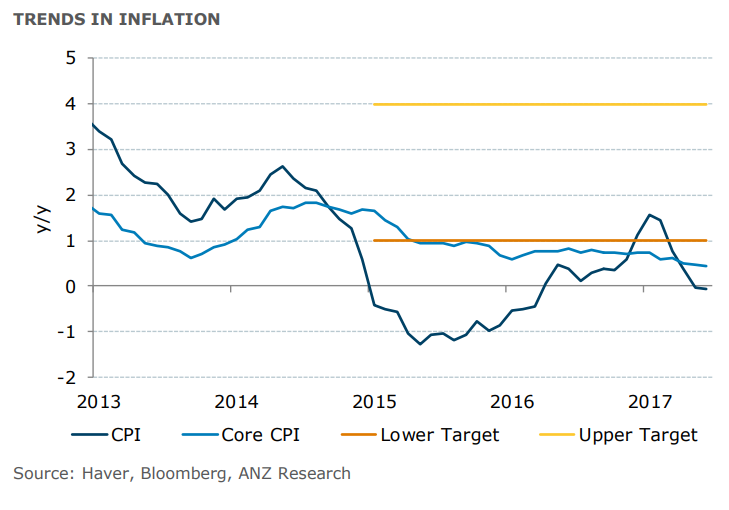

Government data released on Monday showed that Thailand's annual headline consumer prices fell for a second straight month in June, dragged mainly by lower food prices. Headline consumer prices fell 0.05 percent in June from a year earlier, after a 0.04 percent dip in May. Data was slightly better than a projected fall of 0.10 percent in a Reuters poll.

Thailand's headline inflation has remained below the central bank’s 1-4 percent inflation target range for four consecutive months. Core inflation also remained soft, reflecting the lacklustre domestic demand conditions. Weak headline reading has given policymakers plenty of room to keep rates low. Analysts expect The Bank of Thailand (BoT) to keep rates steady at 1.50 percent through 2017.

Thailand inflation is benign and economic recovery is slow while household debt levels are high. Growth in Southeast Asia's second-largest economy has lagged regional peers in recent years. Thailand’s private consumption growth is likely to run in the 3-3.5 percent range in the medium-term, below the 4.5 percent pace that is reckoned to be the current potential. Further, the household debt-to-GDP ratio remains at elevated levels despite easing to 80 percent in 2016, from 81.2 percent in the previous year.

Thailand's central bank meets on Wednesday July 5th to decide monetary policy and it is likely to keep its benchmark interest rate at 1.50 percent, unchanged for more than two years. The BOT, which has forecast growth of 3.4 percent this year, will also review its projection on Wednesday.

"We expect the BoT to keep its policy rate steady at 1.50% this year, despite the moderate growth and declining inflation. The central bank remains of the view that monetary policy is already sufficiently accommodative and further easing will not spark a new lending cycle," said ANZ in a report.

Thai baht declined after CPI data release. USD/THB was up 0.2 percent at the time of writing, trading at 33.99 at around 1030 GMT. The pair is in a major downtrend and is hovering around multi-month lows at 33.82 (last seen since July 7 2015). Strong resistance is seen at 34.23 (50-DMA). Break above could see some upside.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026  Asian Markets Slide as Silver Volatility, Earnings Season, and Central Bank Meetings Rattle Investors

Asian Markets Slide as Silver Volatility, Earnings Season, and Central Bank Meetings Rattle Investors  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons

Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  EU Recovery Fund Faces Bottlenecks Despite Driving Digital and Green Projects

EU Recovery Fund Faces Bottlenecks Despite Driving Digital and Green Projects  Dollar Holds Firm as Strong U.S. Data, Fed Expectations and Global Central Bank Moves Shape Markets

Dollar Holds Firm as Strong U.S. Data, Fed Expectations and Global Central Bank Moves Shape Markets