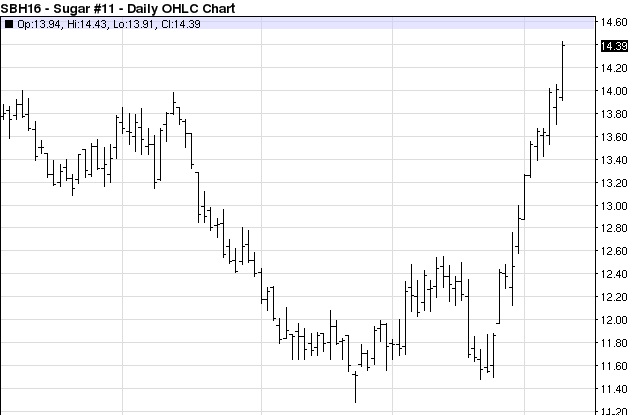

Sugar price has reached highest level at least in seven months. March contract traded as high as 14.39 cents/pound.

According to some analysts, dryness in India and harvest delays in Brazil have contributed to the price.

However such rally, of near about 25% in just about two weeks, suggest sugar price is might have bottomed out and sugar may be entering the deficit cycle. After years of relentless selloffs, which has pushed prices to 10 cents per pound in the spot market in August might be over.

Sugar raises hopes that other soft commodities might turn around as well. In New Zealand dairy prices are up for fourth consecutive auctions.

Last week's CFTC report shows that hedge funds undertook sharp wave of short covering in agricultural commodities led by sugar. Managed money has also raised their long bets in 13 top traded commodities like corn, cotton etc. Last week speculators' net long in sugar rose by 46,722 contracts. Hedge funds have returned to net longs in sugar.

These recoveries in soft commodities are going to be great news for Countries like New Zealand, Brazil, and Ivory Coast etc.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate