National CPI inflation releases today from Germany, eurozone's largest economy point to price growth falling back from a four-year high this month. Flash German inflation data considered as a precursor to Friday's Eurozone ‘flash’ CPI have seen notable drops. Cheaper energy and food prices are likely to have been the main drag.

The surprisingly weak figures from several German states hinted that price pressures in Europe's biggest economy still remain relatively modest. Consumer price growth in Brandenburg is down to 1.4 percent in March from 2 percent in the previous and has declined to 1.7 percent from 2.5 percent in Hesse and Bavaria. The state readings will feed into nationwide inflation data due later today and suggest that German inflation fell more sharply than expected in March.

The weak German state data follows Spanish price figures that also showed consumer inflation eased sharply in March. After rising at their fastest level since 2012, inflation in Spain pulled back more than expected in March. According to INE, Spain's national consumer price index rose by 2.3 percent year-on-year in March, down from 3.0 percent in February. On a month-on-month basis, Spanish national consumer prices were flat, unchanged from the previous month.

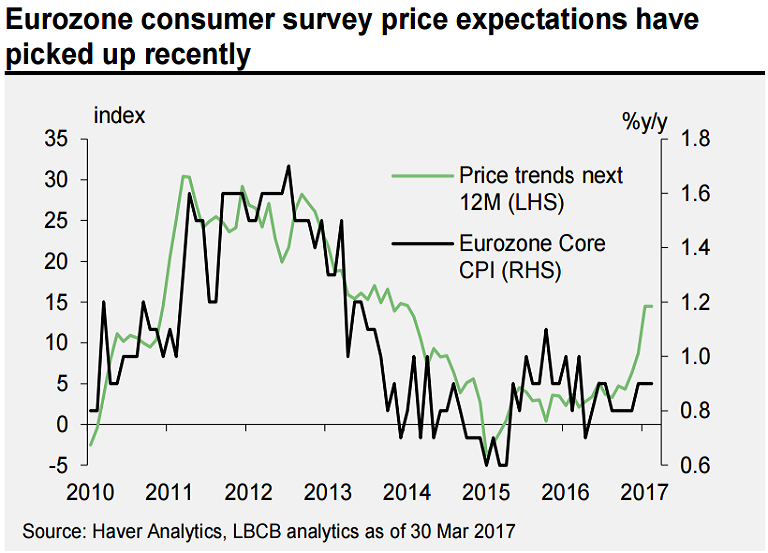

Separate data from the European Commission's monthly sentiment survey showed the eurozone consumer index of price trends over the next 12 months rose to 15.3 points from 14.5 in February, the highest since October 2013. The indicator for selling price expectations among manufacturers also rose to 9.8 points from 9.0 in February, the highest since July 2011.

The inflation rate for the entire euro zone is due on Friday and analysts' expect the eurozone inflation to have fallen to 1.8 percent in March from 2.0 percent in February. The European Central Bank (ECB) has said it needs to see stable inflation rises at the start of the year in the medium term before considering changing policies. Below-target inflation should quell hawks in the ECB.

ECB’s Chief Economist Praet had already rowed back on hawkish rhetoric earlier in the week. A media report yesterday indicated ECB’s hawkish message from March meeting was misinterpreted and that ECB wanted to communicate reduces tail risk, not a step towards exit. The euro weakened as a response. EUR/USD was trading at 1.07350 at around 1215 GMT. Technical studies are bearish. We see break below 1.07350 to confirm minor weakness, a decline till 1.07000 is possible. Any break below 1.0700 (50% retracement of 1.04948 and 1.09058) will drag the pair till 1.06500/1.0600.

FxWirePro's Hourly EUR Spot Index was highly bearish at -118.483 at 1215 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target