The Norwegian central bank really did not revise its key rate forecast to the upside despite a recent strong rise in inflation. Krone eased as a result of the decision and we now feel much complacent about our EURNOK forecast. An important reason behind the unchanged rate outlook, based on which the next rate step will follow in Q1 2019, is the central bank’s slightly lower growth outlook. The mainland economy and the labour market had shown a weaker development than Norges Bank had assumed in June.

As a result of this it now expects slightly weaker wage growth, which explains why it is relaxed about the recent rise in inflation. However, that does not mean that any downside risks are not foreseen for the EURNOK outlook. Norges Bank’s tolerance regarding inflation is high but not unlimited.

Should inflation accelerate further, we would not exclude that the central bankers act more quickly. Just like stronger than expected economic growth is likely to lead to more rapid and more rate hikes. However, at present everything is going to plan for NOK.

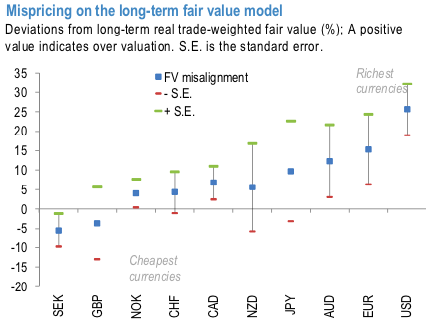

Despite substantial FX market moves, the ranking of currencies on this framework has hardly changed. SEK and GBP remain cheap, while USD, EUR and the Antipodeans remain at the rich end of the spectrum (refer 1st chart).

Since our last publication, CHF, GBP and NOK have outperformed within G10, while the Antipodeans and JPY have underperformed the most. Despite their outperformance, both CHF and NOK remain middle-of-the-pack on this framework.

Among the underperformers, Antipodeans are still on the richer end of the spectrum, as is JPY. Given the recent Antipodean underperformance, the overshoot of these currencies on this framework has declined. However, despite this move these two currencies continue to be the richer relative to the G10 petro-FX (refer 2nd chart). Courtesy: Commerzbank, JPM

Currency Strength Index: FxWirePro's hourly USD spot index has shown -4 (which is neutral), while articulating at 13:43 GMT. For more details on the index, please refer below weblink:

RBA Deputy Governor Says November Inflation Slowdown Helpful but Still Above Target

RBA Deputy Governor Says November Inflation Slowdown Helpful but Still Above Target  New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist

OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation

U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios