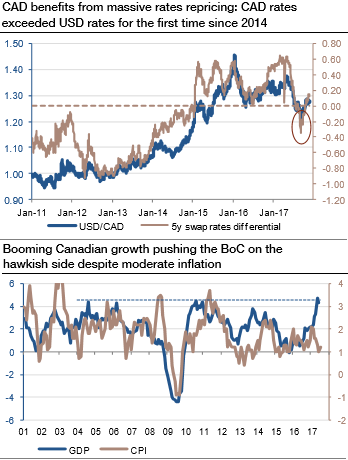

This week BoC is scheduled for monetary policy announcement (on 17th Jan). The Canadian economy was able to grow considerably over the past quarters predominantly driven by an expansionary monetary and fiscal policy. It is projected that the growth rates of around 3% for 2017. Owing to the boom observed, the Bank of Canada (BoC) began to raise interest rates last year in order to counteract possible inflation risks. The consensus is that the Canadian central bank is expected to raise 25 bps in its overnight rates.

For the FX market, the reversal of the previously very cautious BoC came as a surprise in the summer, which is why the CAD appreciated by more than 10% against the USD within three months.

As a result, the BoC has become more cautious and has taken a pause in interest rates. After all, it does not want to burden the economic outlook too much with a strong CAD, which is why the CAD exchange rate should have a considerable influence on the pace of BoC interest rate hikes this year.

In addition to a strong CAD, there are other risk factors that could have a significant impact on the competitiveness of Canadian companies and thus on growth. Risks include not only the renegotiation of the NAFTA agreement but also the significant increase in the minimum wage in the Ontario region at the beginning of the year (further regions are to follow in the course of the year) and the agreed corporate tax reduction in the USA.

Monetary policy to be more decisive than oil prices. The oil performance has been instrumental in boosting the currency in 2017, even though the long-term picture suggests that the currency has overshot the rebound in oil prices. However, the CAD is on the right track to remain strong: the interest rates factor is taking over from the commodity factor. CAD rates recently climbed above USD rates for the first time since 2014 (refer above graph), and our USD rates projections can realistically drag the USDCAD to 1.20.

PPP valuation considerations certainly matter more than in the past. In the commodity currencies bloc, the CAD is close to fair value but the risk of a spike higher is greater for it than for the AUD or even the NZD. In particular, the Australian dollar is largely overvalued, suggesting that short AUDCAD is an attractive valuation-based relative value trade.

Keep short AUDCAD on higher oil prices, activate CAD vs RUB vol as a positive carry, NAFTA-hedged, petro-neutral RV. Buy a 6m 0.9450-0.9120 AUD put/CAD call spread.

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand