Recently, the Russian central bank (CBR) announced that it was officially suspending FX purchases on behalf of the finance ministry until the end of this year; it added that it may resume FX purchases in 2019 but the issue was open. CBR deputy governor Ksenia Yudaeva summarised a few other points – for example, that CBR sees 6%-7% as the equilibrium interest rate for Russia medium-term, but considers the current 7.5% as neutral because of elevated risk premium from sanctions.

RUB seems undervalued and the suspension of the FX purchases on behalf of the budget rule could lead to a convergence to fair value. The budget rule has proved extremely effective in decreasing RUB’s beta to oil and complicates fair value assessments which rely on historical regressions.

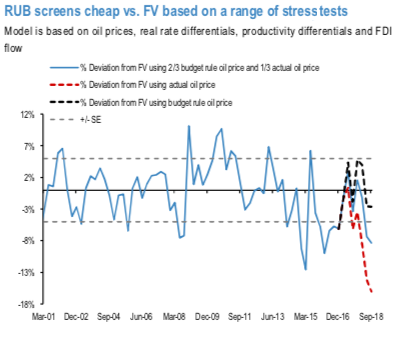

In our preferred methodology, our BEER FV model relies on a weighted average between the current oil price (1/3 weight) and the budget oil price (2/3 weight; $42.8pb Brent). This is most consistent with the “theoretical impact” of the budget rule, in our view. Such an adjustment to the model leaves RUB currently 8.3% cheap to FV.

However, with the CBR extending the pause in its FX reserve accumulation program until year-end, oil could have a more pronounced impact on RUB in line with historical betas. Relying on actual oil prices (with no budget rule adjustment), would show RUB as substantially undervalued, by around 16% (refer above chart).

Importantly, the full current account surplus (6.6% of GDP in Q2 2018) can now directly support the currency. We estimate CBR will over the full period of the suspension forgo about $27bn of FX purchases. However, considering substantial and unpredictable geopolitical risks, we would recommend to rely exclusively on option exposure for RUB appreciation plays.

Buy 3M USDCAD 25D call vs sell USDRUB 25D call, in 1.8:1 vega. Oil hedged EM – DM vol compression RV with NAFTA edge.

At spot reference: 66.595 levels, 06-Nov-18 USDRUB 1x1 put spread (69.36/64.14) is advocated. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 83 levels (which is bullish), while articulating (at 13:44 GMT). For more details on the index, please refer below weblink:

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady