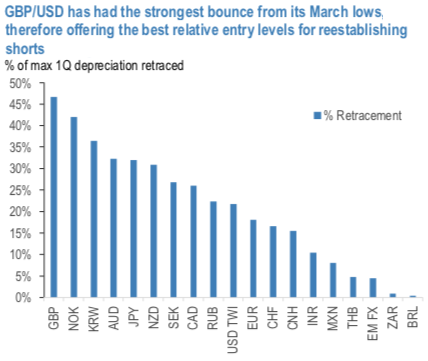

Short GBPUSD is the preferred candidate to raise our long USD, defensive exposure once again after the rounds of profit-takes of recent weeks. As evident from the above diagram, cable has retraced from its lows more comprehensively than any other currency. While this of course in part reflects the severity of the initial slump that we were positioned for in GBP (17 cents in barely 10 days) it would be wrong, in our view, to dismiss that slump as an unwarranted overreaction on the part of GBP to the COVID-19 fallout to compound of course the unique damage from Brexit. After all, the UK is more exposed to a sudden stop in global capital flows given the UK’s outsize current account deficit (notwithstanding the fact that the 1H slump in activity should temporarily reduce this deficit). In addition, the UK has a larger international balance sheet than its peer group which leaves GBP susceptible to a certain repatriation of foreign capital (the UK's gross foreign liabilities are 4x GDP). GBP may be one of the cheapest major currencies on a long-term REER basis (the CPI-based REER is at an all- time low, some 22% below the 50Y average), but this is unlikely to act as a stabilizing force in its own right, i.e. we doubt whether the currency risk premium is sufficient to attract inward investment flows during a period of such unprecedented economic disruption. In addition, we are not convinced that this early in the process it is possible to handicap the relative resilience of different economics to the COVID fallout, irrespective of the extent and significance of domestic policy support. So while the UK government and BoE have been pro-active and indeed creative in broadening the reach of public sector support to the economy, we do not yet regard this as source of meaningful reassurance for GBP.

Trade Tips:

Uphold shorts in GBPUSD spot at 1.2450, stop at 1.270.

Contemplating some technical rationale, at spot reference: 1.2435 levels, the tunnel spreads are advocated on trading grounds with upper strikes at 1.2495 level and lower strikes at 1.2375 levels.

Alternatively, activated shorts in GBPUSD futures contracts of April’20, we now wish to uphold the same strategy by rolling over May month deliveries with an objective of arresting potential slumps. Courtesy: JPM

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  Copper Prices Hit Record Highs as Metals Rally Gains Momentum on Geopolitical Tensions

Copper Prices Hit Record Highs as Metals Rally Gains Momentum on Geopolitical Tensions  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Slides as Warsh Fed Nomination, Hot Inflation, and Precious Metals Rout Shake Markets

Wall Street Slides as Warsh Fed Nomination, Hot Inflation, and Precious Metals Rout Shake Markets  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics