The full unwind of the post-election Trump trade, which has led to a weaker US dollar and lower US Treasury yields, has supported gold’s relatively strong performance this year.

To reflect a more benign inflation outlook and reduced likelihood of fiscal stimulus, our rates strategists have lowered their interest rate forecast for the balance of the year.

The Fed has delivered another ‘dovish hike’ similar to one in March as anticipated, which would be constructive for gold.

Beyond our short-term tactical recommendation, our broader view on gold is that prices will remain largely range-bound especially from the last five-six months. We increase our 3Q and 4Q prices by 3-4% and now see gold averaging $1,240/oz in 2H17.

Bearish Scenarios:

a) Fed raises rates faster and more aggressively than expected;

b) The dollar significantly strengthens from current levels;

c) ECB and BoJ take definitive steps away from accommodative monetary policy;

d) Asian physical buying is weak even during seasonally strong periods;

e) The central banks actually begin selling gold on net.

Bullish scenarios:

a) Fed sends dovish signals throughout 2017, weakening the dollar;

b) The central banks around the world move deeper towards negative rates;

c) EM economic worries spread and global recessionary risks rise;

d) The sharp pickup in Asian physical buying.

OTC outlook and option Strategy:

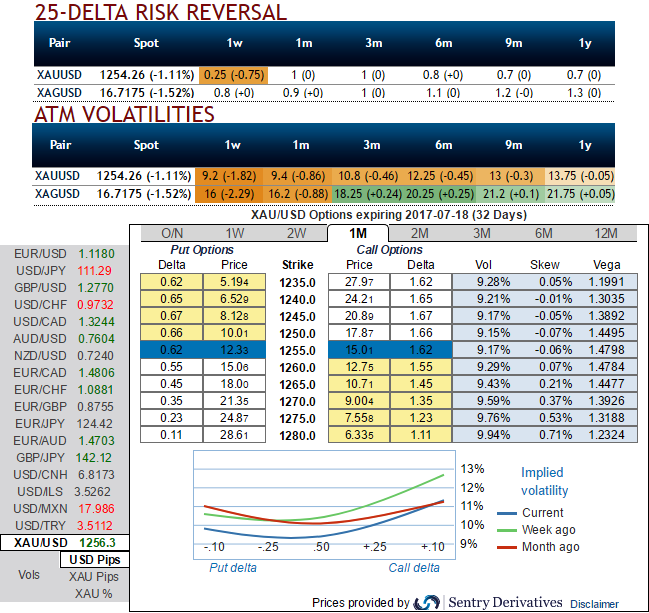

Please be noted that the OTC markets for this precious metal have been indicating the bearish hedging sentiments in the near run (see 1w risk reversals), while long-term risk reversals have been bullish neutral.

The implied volatilities have been shrinking away after dovish Fed fund rate hikes, these IVs have been positively skewed on both OTM call and OTM put strikes.

Accordingly, we could see the bearish sensation in the underlying prices but the major trend has been non-directional as stated in our previous technical write up. Visit below weblink for more details on technical analysis of gold prices:

On the Comex division of the NYME, gold futures for August delivery were up 0.14% at $1,256.40.

For today, Gold prices edge higher but hover near 3-week trough.

Gold is sensitive to moves higher in both U.S. rates and the dollar. A stronger dollar makes gold more expensive for holders of foreign currency while a rise in U.S. rates, lift the opportunity cost of holding non-yielding assets such as bullion. Accordingly, in order to keep price turbulence on the check, the below hedging recommendation using options were devised:

Initiate long in 1m ATM +0.51 delta call, and simultaneously buy ATM -0.49 delta put of the same tenor for the net debit, while shorting 1w (1%) OTM calls bidding risk reversals and shrinking IVs.

Well, this options trading strategy that is used when the options trader ponders that the underlying gold prices would experience significant volatility but not sure of the direction of the swings.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis