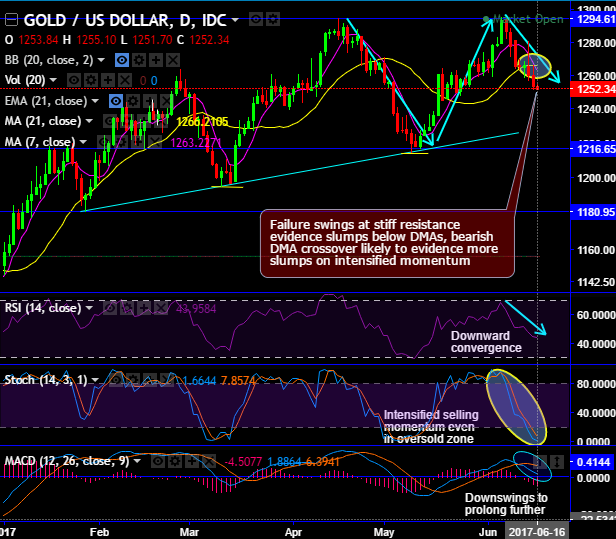

Gold price behavior has been moving in rising trendline with the triple top formation (refer daily charts).

Top 1 at 1263.87, top 2 at 1295.46 and top 3 at 1294.91 levels.

Failure swings at stiff resistance have evidenced slumps below DMAs. Currently, heading towards 4-weeks’ lows at 1248.08 levels (just 5 dollars away from current levels).

For now, the bearish DMA crossover likely to evidence more slumps on intensified momentum.

The current prices are well above DMAs amid today’s mild downswings for the day, but slumps seem to be most likely as it is attempting to breach below strong supports at 1261 levels.

RSI shows downward convergence to the price dips that indicates the strength in bearish trend and stochastic curves have reached oversold territory but still signaling selling pressures.

While on a broader perspective, the bulls in gold prices in consolidation phase is hampered by shooting star and doji candles occurrences that signal weakness again.

But current prices still above 21EMAs in the consolidation phase, 21-EMA cushions to confront interim bears. From last five months, the precious metal has been oscillating between 1195 -1295 levels.

Both leading oscillators on this timeframe (RSI & stochastic) have been indecisive but mildly bearish bias.

MACD on daily terms indicates price dips to prolong further, while on monthly timeframe has been a little skeptic about the trend direction.

Trade tips:

On intraday trading perspective, we see upside barrier at 1263 (i.e.7DMA) and on southwards at 1243 levels, accordingly, we advocate trade in boundary binary options to fetch the leverage yields. Using such speculative leveraged instruments the returns will have magnified effects than spot trades as long as underlying commodity spot prices remain between these two strikes on expiration.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings