Post FOMC meeting on Wednesday which was delivered (25 bps rate hikes) as widely anticipated, the USD has extended its rebound from range lows, while US yields and equities remain in a consolidation phase. The Fed’s statement highlighted that inflation was "near targets", so all eyes on today’s PCE deflator readings, which are expected to slip back to 2.2% from 2.3%, while core is predicted to hold around 2.0%.

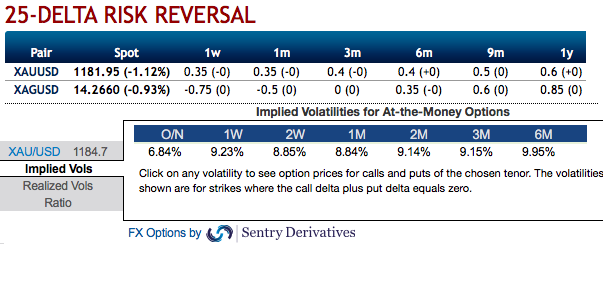

Bullion OTC outlook:Positively skewed IVs of 2m XAUUSD (gold options) have been well balanced on either side that signifies the hedgers’ interests on both OTM call and OTM put strikes. While risk reversal (RRs) numbers have been bullish neutral.

While the combination of 2m IV skews and bullish neutral RRs coupled with shrinking IVs indicates 3-way options straddle as lower IVs are conducive for writing overpriced OTM calls. Using three-leg strategy would be a smart move to reduce hedging cost.

3-way options straddle versus OTM call: Initiate longs in XAUUSD 2M at the money -0.49 delta put, and go long 2M at the money +0.51 delta call and simultaneously, Short 2w (1%) out of the money calls. Thereby, we favor bulls as we foresee more upside risks by keeping longer tenors on call leg.

While it is reckoned that as per the OTC indications as shown above and the prevailing trend of gold (XAUUSD) seems to be reasonably addressed by hedging participants, the risk-averse traders who are dubious about the trend direction but slightly upside biased.

All these indications are taken into consideration and advocated below option strategy to keep uncertainty in spot gold prices on check. The strategy likely to fetch positive cashflows regardless of underlying price swings with more potential on downside and with cost effectiveness.

Calendar spread for vols flatness: The flat gold vol curve also motivates one- touch calendars (OTs), which fit with a modestly bearish near-term but eventually constructive view for gold prices, as per our analysts’ price forecast profile. The 3rdchart exhibits a rundown of short front vs. long back tenor OTs that showcase TV of 40% (5% spot to strike distance) and 60% (2.5% spot to strike) on long leg and achieve about 5.5X for -2M/+4M and >6.5X gearing in case of -3M/+5M.

We recommend: sell 2M vs. buy 4M 1,250 strike XAUUSD one-touch call option calendar spread @13.5/17.5 %USD at spot ref 1,207.8551. The structure shows 5.8X leverage and has 20.0% static carry at expiry of the short leg. Courtesy: JPM

Currency Strength Index:FxWirePro's hourly USD spot index is inching towards 144 levels (which is bullish), while articulating at (11:52 GMT).

For more details on the index, please refer below weblink:http://www.fxwirepro.com/currencyindex

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence