The positive US data on Friday (Bureau of Labor Statistics’ report and University of Michigan consumer poll) ended the move in EURUSD into the area above 1.11. levels. It is unable to remain above 1.11 nor below 1.10 - that seems to be what the last weeks taught us. The exchange rate slipped into that area on 5th November and has only recorded very short term and unsuccessful breeches to the up or downside.

Despite the fact that at just above 7% realized intraday volatility is not even that unusually low. On Friday for example the market moved quite rapidly from approx. 1.1100 to 1.1050. The assumption that volatility behaves similarly in different time scales (or to express it in a mathematical manner, that it scales at square root of t) is not always met. The world is not as simple as Fischer Black and Myron Scholes imagined. As however option prices are based on the cost of dynamically hedging an option position and as the options market makers typically work in a high frequency manner, FX volatilities - even if 1M EURUSD ATM volatility is not high at approx. 6 3/4 % - still do not reflect the low FX volatility that can be witnessed in low frequency areas.

Anyone wanting to hedge against medium term exchange rate fluctuations will have to think twice whether writing options might not be the better strategy rather than buying options. Those who think so, the fear that the FX market will not develop the momentum ahead of Christmas to decide for one direction or the other.

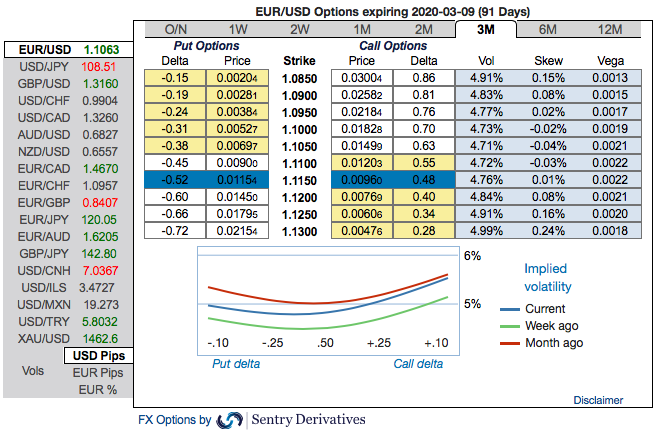

Otherwise, 3M EURUSD IVs would hardly be stuck around the 4-5% mark and it has been prolonged. If one ignores GBP volatility though the FX market has returned to the vol lows seen last summer. The hopes are lingering that the vol levels seen at the time would be short-lived was correct in the sense that volatilities rose significantly in August.

However, there is no sustainable escape from the structural low volatility environment - that much has become clear. That is seemingly positive for all those for whom FX is an undesirable risk. IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility, and it is quite impossible for any veteran to ascertain accurate future volatility.

EURUSD low IVs persist despite the US Fed and ECB monetary policies that are scheduled for this week. Skews and Risk reversal numbers have indicated mild bullish pressures amid major downtrend (refer above exhibits).

Hedging Strategies: Contemplating above factors, initiated long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, write an (1%) out of the money put option of 2w tenors, (spot reference: 1.1063 level). Short-legs go worthless as the underlying spot price hasn’t gone anywhere. Any slumps from here onwards are to be arrested by the 2 lots of ATM long-legs.

Those who are sceptic about mild rallies, 3m 1% in the money puts with attractive delta are advised on a hedging ground. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.

Those who want to participate in the prevailing rallies in the short run, one can freshly initiate the strategy. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately. Courtesy: Sentrix & Saxobank

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation

U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data