The ECB’s Draghi highlighted increased downside risks on a host of uncertainties and near term growth is expected to be weaker than previously expected.

The euro made a new low for 2019 at 1.1304 on bets that the European Central Bank would, at its governing council on Thursday, deliver a downbeat economic outlook. With the ECB downplaying recession risks, this has pushed out rate hike expectations into 2020.

The European Central Bank held its benchmark refinancing rate at 0 percent on January 24thand reiterated it expects key interest rates to remain at record low levels at least through the summer of 2019. The central bank brought to an end its €2.6 trillion bond purchase scheme last month but said it will keep reinvesting cash from maturing bonds for an extended period of time.

OTC Updates and Options Strategies:

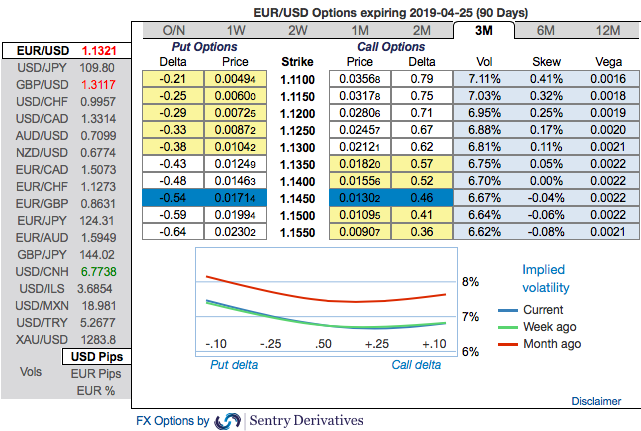

EURUSD 3m positively skewed IVs have been signaling downside risks

Skews stretched towards OTM put strikes signifies hedgers interest in the further bearish risks.

To substantiate these indications, we observe the fresh bids to mounting negative RRs in the 1m coupled, while bearish neutral RRs in the longer tenors remains intact which is in line with the above-stated bearish scenarios.

All these indications coupled with the fundamental news and the underlying scenarios are attractively appealing put holders. Contemplating all these factors, we advocate below options strategy.

The strategy: Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors. Dubious bulls can also deploy 1% in the money puts with attractive delta. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.

Alternatively, shorting futures of mid-month tenors are also advocated with a view of arresting further potential slumps. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: Sentrix, Saxobank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -92 levels (which is bearish), while hourly USD spot index was at -6 (neutral) while articulating (at 08:17 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts