NZDJPY minor trend: Stronger global stock-markets in January have taken the shine off the defensive yen and increased appetite for the risky NZD. So too has the slowing Japanese economy. We only target for 76.0 in the near terms. Further de facto tapering by the BoJ is looking less likely, adding upside risks to the 76.0 forecasts.

Medium-term perspectives: The prime driving force of this week-ahead outlook would be the RBNZ MPS. A dovish shift in stance, along with the lines of that seen in the US and Australia, would renew downward pressure on NZDJPY and target 72.000 levels.

If the risk appetites fail to stabilize that would be a poor signal in our eyes and leave the NZD at risk of breaking down towards new multi-year lows. We are quite confident and complacent with our end of year NZDJPY projections at 72.000 levels.

NZDJPY’s trend has been within the tight range of 75.569 – 72.289 levels, but the pair is having more bearish traction and expected to depreciate up to 72.289 levels by the end 1H’19 as RBNZ outlook remains on hold. Governor Orr declared that the OCR will need to be on hold until 2020 in order to sustainably hit the inflation target.

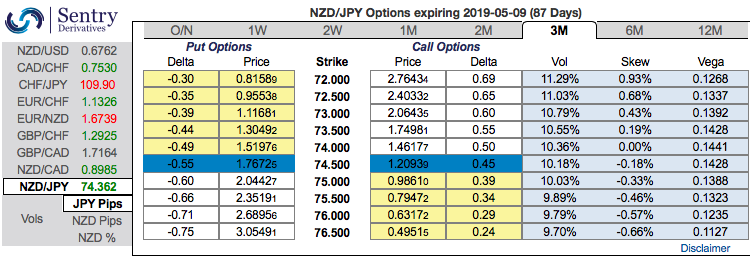

To substantiate the bearish stance of underlying spot FX, the 3m positively skewed implied volatilities also indicate the hedging sentiments for the lingering bearish risks. Bids are for OTM puts up to 72.000 levels.

As a result, at spot reference: 74.250 we construct suitable options strategy favoring slightly on the bearish side. Initiate longs in -0.49 delta put options of 3m tenors, simultaneously, short (1%) out of the money put options of the narrowed expiry (preferably 2w tenors), the strategy is executed at net debit.

Well, a higher (absolute) Delta value is desirable on the long leg in the above-stated strategy. Whereas, the Theta is positive on the short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry). The short side likely to reduce the cost of hedging with time decay advantage on the short leg, while delta longs likely to arrest potential bearish risks. Courtesy: Sentrix & Westpac

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -154 levels (which is highly bearish), while hourly JPY spot index was at 73 (highly bullish) while articulating (at 08:15 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026