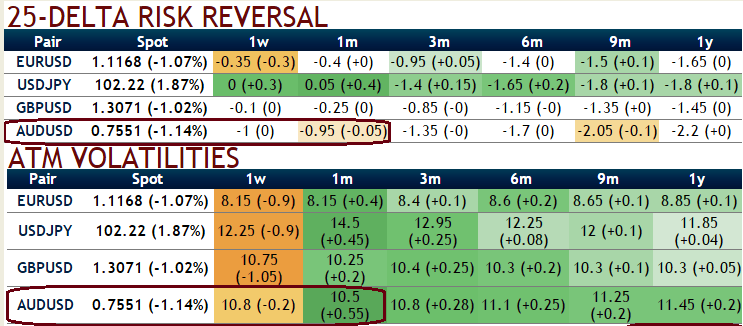

Please be noted that the resilient changes in risk reversals 1w, 1m to 3m tenors, the negative tickers in delta risk reversals in 1 month’s tenor that signify the puts are on higher demand and so priced at a higher premium than calls (which would mean that AUD’s downside protection is relatively more expensive).

Significant changes can indicate a change in market expectations for the future direction in the underlying forex spot rate.

Let’s glance through the gradual rise in IVs during 1m-3m tenors which are good news for option holders, while option writers can capitalize on 1w expiries.

July building approvals in Australia significantly rose by 11.3% from the previous flash -4.7%.

RBA’s monetary policy is scheduled in 1 week of September; the strong data challenge the RBA’s more benign view of the housing market. While we would caution against reading too much into what can be a very volatile series, the pick-up in both approvals and auction clearance rates challenges the RBA’s view that the risks of reigniting the housing market have eased, particularly with renewed strength in daily house prices in Sydney and Melbourne.

Fed’s Vice Chair Fischer will be speaking overnight (8:30pm AEST) which may drive added volatility. Any backpedalling may see an outsized rally in risk currencies, including AUD. Notably, despite a strong rally in UST today, the USD was relatively flat.

US rates rallied overnight, partially reversing Friday night’s move. Australian yields are likely to open lower.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.