The event the world has been awaiting, preparing and speculating for is finally approaching - meeting by US Federal Reserve, in which US interest rates will finally rise from their zero bound. After Friday's super job report market is now pricing 81% probability that FED will hike rates in its December meeting, scheduled for December 15th-16th.

In this, FED liftoff series we will be discussing over the impact, implications and various possibilities of a first rate hike from FED after more than 9 years. Last time FED hiked rates was back in 2006.

In this piece, we address why a rate hike from FED is still crucial, taking into account months if not years of expectations and almost full pricing of a hike.

Why a hike from FED is still crucial?

We believe, FED rate hike likely to impact in two ways, which would be most crucial and it could have various side effects arising from that.

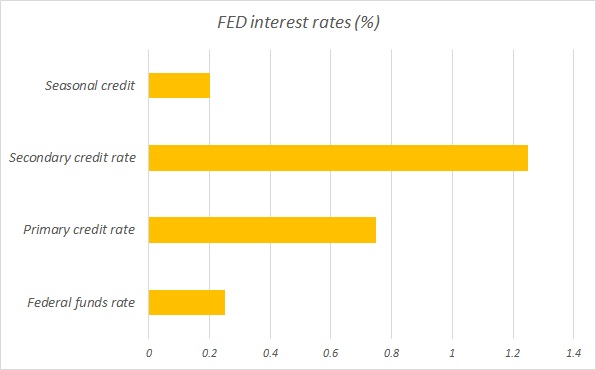

Interest rates -

Though rates have firmed across the board, treasury yields, mortgage rates actual Federal funds rate have not increased, which means Banks parking money at FED still get about 0-0.25% return. Moreover financial institutions can finance and refinance at the same cost (if needed) at the same rates (those who can transact with FED), they could few years back, in spite of rise in yields.

Expect discount rates also to move up (last minutes show, most of the participants wanted it to go up). That will directly increase the cost of stress funding.

Actual hike from FED are likely to change that, which even if not immediately, but eventually will lead to further firming of rates across the board.

Reason is market will be expecting further hikes from FED even if it comes gradually. At least another hike is expected next year. This change in monetary policy stance, will also bring focus to FED's massive $4 trillion balance sheet. Speculation likely to run in that direction too.

We expect, this rise in rates would make investors and banks more risk averse when lending to emerging market corporates, who since the financial crisis, thanks to lower rates have ballooned their balance sheet with cheap debt. Due to Dollar's abundance and more than 60% share in reserve currency, FED is central banker to the world, which means rate could rise even in Europe, despite ECB easing (which is not looking so great after last Thursday.

Strong Dollar -

Bank of England (BOE) was expected to follow in FED's footsteps, at turn of the year, which got slashed in last BOE inflation forecast, which said inflation not likely to overshoot, if rates from BOE remain at present level. Pound was originally expected to steal the lime light from Dollar, once FED hike is done with.

With Pound gone, rate betters are again left with Dollar to speculate over next hike and balance sheet reduction. And with FED hiking rates, actual return to hold Dollar would move up.

Stronger Dollar from here could further affect all assets ranging from commodities to EM debt.

Now taking the contrary view, Dollar to weaken against most of world currencies after FED hike pose issues none the less. Weak Dollar and weak commodities over China would be far worse than current scenario and domestic currency income would go down.

Side effects

There could be various side effects to FED rate hike, some of them would be direct some could be indirect.

FED hike could indirectly contribute to global risk premia by pushing it higher, even a marginal elevation would be sufficient for sharp blow to equities. It can even contribute to higher duration premia. With FED hike, there would be reprising in various models of equity valuation, though we feel sizable chunk of that has already been taken care off.

Some direct impact could be in countries that maintain a dollar peg, such as Hong Kong, Saudi Arabia. With Fed hike, interest rates would go up in Hong Kong too (since it follows FED). And that be at a time when its largest trading partner China is slowing down.

To conclude, FED hike will signal the beginning of the end of global monetary easing. Better be prepared for it.

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence